News

BT Launches New Integrated Voice Service

The telecommunications provider has launched One Voice Radianz, an integrated service that will bring together voice, mobile, and data services for financial services users of its flagship BT Radianz Cloud.

SIX Picks Pluris for ARS Pricing

SIX Financial Information has incorporated pricing on auction rate securities (ARS) covering municipals, student loans and preferred stock from New York-based evaluated pricing provider Pluris Valuation Advisors into its evaluated pricing service, to…

Nasdaq Unveils Capital Venue for Private Companies

Nasdaq OMX has launched Nasdaq Private Market, its new capital marketplace for private companies.

Dutch Pension Fund Selects Misys for Portfolio Management

Blue Sky Group, a EUR 17b pension fund based in the Netherlands, has chosen Misys Sophis Value as its core portfolio management platform.

Swift Partners with Major Banks on KYC Utility

Swift plans to launch a central utility for know-your-customer data later this year and is working with six major banks, who are sharing their views on the processes, documentation and data needed

FRS Launches Analytical Tool for Life Insurer

Financial Risk Solutions (FRS), the Dublin-based software provider to the life insurance industry, has announced the launch of Invest|Pro Analytics, a web-based reporting and control tool for fund administration.

Investment Managers Outsourcing Dealing Desks

According to a recent roundtable discussion hosted by London-based Fidessa, certain investment managers are considering outsourcing parts of their dealing desks to become more competitive in today’s market environment.

SFI Taps Vets Miller, Hillier-Brook for UK, Euro BizDev

Startup data technology vendor Simplified Financial Information has hired two veteran data industry executives─Andrew Miller and Ian Hillier-Brook─as managing directors in London, responsible for business development throughout the UK and Europe.

SSgX Adds Futures Execution to FCM Solution

State Street Global Exchange (SSgX) has expanded its futures commission merchant (FCM) solution to include futures execution.

BNY Mellon CSD to Begin Securities Settlement in Luxembourg

BNY Mellon has announced its Brussels-based central securities depository (CSD) has been recognized as a securities settlement system by the Luxembourg Stock Exchange.

Former BondDesk CEO Joins Algomi as Strategic Advisor

London-based fixed-income technology provider Algomi has appointed Howard Edelstein, former chairman and CEO of BondDesk Group, as strategic advisor.

SimCorp Updates Dimension

In the first of two upgrades planned for 2014, Copenhagen-based vendor SimCorp has released version 5.5 of its flagship SimCorp Dimension investment management solution.

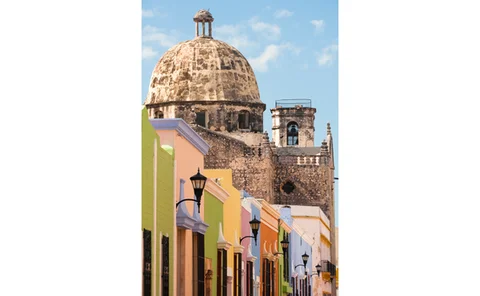

Mexico's Intangible Investments Live on iLevel

The Mexico City-based venture capital firm will be the first in the country using iLevel's Private Capital Data platform, and third in Latin America after Colombia's Tribeca Asset Management and Brazil's Patria Investimentos.

Markit Taps SMA for Social Media Sentiment Indicators

Markit has integrated social media sentiment indicators from Social Market Analytics, a Naperville, Illinois.-based provider of social media-based analytics and trading indicators, into its Markit Research Signals suite of more than 400 investment…

Perseus Bakes Low-Latency London Microwave Network

New York-based fiber and microwave network provider Perseus Telecom has built a series of wireless microwave networks connecting key datacenters in and around London to provide market makers and latency-sensitive traders with ultra-low latency…

Dubai Murabaha Commodities Platform Adds BGC

The interdealer broker will be the first on Dubai Multi Commodities Center's (DMCC's) electronic Tradeflow system, launched in 2013, for trading in niche Islamic finance products.

Nasdaq Extends New Feed Tests

Nasdaq OMX has delayed the end of beta testing for a suite of enhanced datafeeds by two weeks to ensure direct feed subscribers have adequate time to test the new versions.

AxiomSL Expands XBRL-Related Capabilities

To meet new reporting requirements related to the eXtensible Business Reporting Language (XBRL), AxiomSL has enhanced its out-of-the-box XBRL reporting solution to include taxonomy management and tweaked it to be more of a submission platform, rather…

CLS Appoints Ken Harvey Chairman of the Board

Ken Harvey has been appointed chairman of the board of directors of CLS Group and CLS Bank International, bringing over 30 years of financial expertise to the role.

Thomson Reuters Adds Oil Supply Flows Data to Eikon

Thomson Reuters has added a new tool to its Eikon desktop to enable commodity traders and investors to track the global movement of oil assets in real time and forecast the impact of supply and demand on market prices.

New OpenCorporates API Includes Access to Corporate Network Data

The new application programming interface gives users of the database of corporate entity data access to the US Federal Reserve's hierarchy data on bank holding companies and other new information

MahiFX Launches e-FX Suite for Institutional Clients

Foreign-exchange (FX) trading technology provider MahiFX has launched MFX Compass, a suite of FX trading tools designed for institutional clients.

Newedge Adds Ullink Post-Trade Monitoring Solution in Asia

Multi-asset broker Newedge has added UL Monitoring, a post-trade monitoring solution from connectivity and trading solution provider Ullink, to its Direct Market Access (DMA) platform in Asia.

McKay Offers Three-Month, No-Obligation Microwave Contract

Oakland, Calif.-based microwave connectivity provider McKay Brothers has established a new market data service that makes it easy for traders to test its service over a three-month period, in response to an increase in the number of firms expressing…