News

Exchanges See Data Revenues Rise

Exchanges continue to report increases in market data revenues in their financial results, following a raft of similarly largely positive results in recent weeks (IMD, Feb. 17)—though, post-financial crisis, Latin America and Asia are no longer…

Tradition Revamps Forward Swaps Data; Preps ParFX Data Offering, HFT Neutralizer

Interdealer broker Tradition has launched a new data service that combines executable price data from Trad-X—the interest-rate swap trading platform run by Tradition in partnership with 12 investment banks that covers 250 of the most liquid interest-rate…

Maple Leaves HFT Co-Lo for SpryWare Cloud

A proprietary trading group at Maple Securities USA, the US subsidiary of Canada’s Maple Financial Group, is finalizing a migration from direct exchange feeds and an in-house co-location operation to a managed market data infrastructure run by Chicago…

Startup Arialytics Exits Platform Sales, Re-Positions as Data Vendor; Nests with RavenPack

Rye, NY-based analytics startup Arialytics has repositioned its offering over the last six months to now solely sell predictive indicators generated by its Aria cross-asset-class predictive analytics platform─which the vendor unveiled last May─rather…

Eze Mulls Buying a Risk Company

Eze Software Group may purchase a risk software vendor in the near future, according to co-president David Quinlan.

Roberts Group Adds Bloomberg Price List Processing Utility to New FITS Release

New York-based data inventory and cost management software provider The Roberts Group has rolled out version 3.61 of its FITS (Financial Information Tracking System) market data inventory management platform, which includes a new tool for automating pre…

Imagine Adds New Risk Service, Eases Spreadsheet Reliance

Last week, Imagine Software announced it was expanding its Imagine Financial Platform (IFP) and App Marketplace with the launch of Imagine Risk Services. Officials say this latest rollout will provide users with greater customization for portfolio…

Options Opens West End London Support, Sales Office

Infrastructure-as-a-service provider Options (formerly Options IT) has opened a new office in London's West End district─in addition to its existing base in Wimbledon, in southwest London─to better support customers located in central London.

Datacom Expands TradeView Monitoring Appliance

East Syracuse, New York hardware switch vendor Datacom Systems has released version 1.6 of its FPGA-accelerated TradeView appliance for monitoring multicast gap, traffic and microbursts.

SimCorp Buys Reporting Specialist Equipos

Copenhagen-based vendor SimCorp has acquired Equipos, a London-based developer of reporting software.

SimCorp Acquires Client Reporting Software Provider

SimCorp hopes to capitalize on demand for client reporting technology by combining its performance, risk and accounting capabilities with the reporting functionality from Equipos

Burton-Taylor: Data Demand Falls in 2013; Spend Driven by Price Hikes

Global spend on market data and analysis increased by 1.1 percent last year from $25.5 billion in 2012 to $25.88 billion in 2013, but would have been fallen if not for vendor price increases of an average two percent, according to research from Burton…

Bats Chi-X Europe Hires Jill Griebenow as CFO

Bats Chi-X Europe has appointed Jill Griebenow as chief financial officer with immediate effect. She will be responsible for all financial controls and human resource functions, including financial planning and reporting.

CME Clearing Europe Set To Expand Swaps Support

CME Clearing Europe, the Chicago Mercantile Exchange (CME) Group's European clearing house, has received Bank of England approval to add a number of derivatives to its interest-rate swap service.

Multi-Bank Group TESI to Adopt Fix Protocol

The Fix Trading Community has announced that the Trading Enablement Standardisation Initiative (TESI), developed by Etrading Software and supported by the investment banking community, has adopted the Fix Protocol guideline in order to reduce operational…

CMC Picks Colt as Datacenter Provider

London-based derivatives dealer CMC Markets has signed a 12-year agreement with UK-based network and hosting services provider Colt to act as its preferred datacenter provider, in a move to boost operational efficiency and increase clients' connectivity…

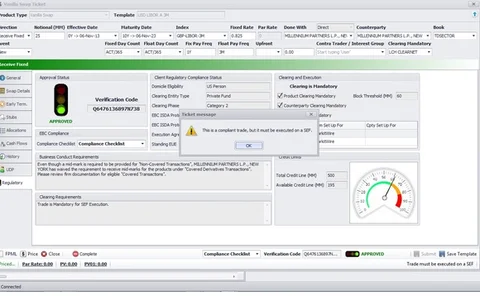

Kinetix Adds New Regs Support to Data Compliance Tool

Princeton, NJ-based trading technology provider Kinetix Trading Solutions has added support for new regulations to the Pre-Trade Verification module of its Monaco trading platform, which combines market data with trading firms' databases of counterparty…

EFront to Streamline Portfolio Monitoring for Private Equity

EFront, a Paris-based provider of alternative investment solutions, believes its latest product will reduce the process of gathering portfolio company data by private equity investors from weeks to hours. FrontPM offers portfolio monitoring and analysis…

Spain's BME Grows IBEX Index Data

Spanish exchange group Bolsas y Mercados Españoles plans to begin distributing data on eight new tradable indexes to its IBEX series that will serve as underlying assets for financial products, such as warrants, certificates and exchange-traded funds, to…

Interactive Data Adds MT Newswires' US, Canada News to Market-Q Desktop, App

Interactive Data has integrated US and Canadian news and analysis from MT Newswires─a division of Midnight Trader─into its Market-Q web-based data terminal and its accompanying Market-Q Mobile platform.

Charles Thomas Appointed Wells Fargo CDO

Charles Thomas, who has worked at the United Services Automobile Association since 2008, will take up the role of chief data officer at Wells Fargo in March

Aviva Investors Goes Live with Commcise Commission Management

London-based asset manager Aviva Investors has implemented a commission sharing agreement (CSA) and share-of-wallet management software solution from Commcise.

Perseus Buys TLV for Low-Latency CME-ICE Microwave Data

Network provider Perseus Telecom has acquired Broadview, Illinois-based TLV Networks, which operates a low-latency microwave network connecting Chicago-based futures exchange matching engines, from wireless network infrastructure design and management…

JSCC Taps Calypso for Client-Clearing Services

The Japan Securities Clearing Corporation (JSCC), a member of the Japan Exchange Group, has gone live with Calypso Technology’s system for client clearing of JPY interest-rate swaps (IRS) and collateral management.