News

NFEA Taps Moscow Exchange FX Fixing for Swap Rates

Russia's National Foreign Exchange Association has announced that from Jan. 9, it will begin using the Moscow Exchange's US dollar-ruble price fixing to calculate the NFEA FX swap rate instead of the current Central Bank of Russia rate.

Market Data Industry's Top Quotes of 2013

Our gift to you: some of the most poignant and pithy comments from our pages in 2013

2013 Review: Herd in Review: Necessity Is the Mother of Invention

As we take today to celebrate and surround ourselves with friends and family, it's worth remembering the difference that the actions of other people make--in the data industry as well as in our everyday lives. So in IMD's final 2013 Year in Review…

NYSE Delays Order Imbalance Data Fees─Again

NYSE Technologies has delayed the introduction of new fees for order imbalance data from parent NYSE Euronext's New York Stock Exchange and NYSE MKT marketplaces for a second time.

Markit Connects to HKMA Trade Repository

MarkitSERV has connected to the Hong Kong Monetary Authority's (HKMA) trade repository, the data provider has announced.

2013 Review: EU Consolidated Tape Encounters Hurdles to Implemenation

Progress continued on the long uphill road toward the introduction of a pan-European consolidated tape, but suffered a setback this year after regulatory uncertainty over MiFID 2 led to the dismantling of industry-led group The COBA Project, which was…

2013 Review: Crowd-Sourced Content, Search Gain Traction

As traders and investors seek new ways to find alpha in increasingly commoditized datasets, the accuracy of data and how it is sourced—and the ease with which it can be searched—is becoming more important, prompting the creation of new services for…

OPRA Seeks New SIP Operator, Enlists Jordan & Jordan to Run RFP

The Options Price Reporting Authority has begun a tender process for a technology supplier to manage the SIP (securities information processor) that collects data from US options exchanges, calculates a best bid and offer, and distributes OPRA's…

2013 Review: Traders Weigh Importance of Fast Data vs Big Data

While still a focus for high-frequency traders with latency-sensitive strategies, the latency arms race appeared to have reached a stalemate in 2013, with low latency a necessity but ultra-low latency more of an expensive luxury, with some firms…

Esma Updates Derivatives Reporting Guidance

The European Securities and Markets Authority (Esma) has clarified its position on the reporting of derivatives, updating an online Q&A with the scope of requirements, as well as the counterparties that it expects to report transactions.

Citicom Partners Tango for Call Recording

Citicom Solutions has announced a partnership with Tango Networks, where the latter will provide a network-based voice recording facility for Citicom Assure.

Bloomberg Names Risk and Compliance Exec

Bloomberg is making good on its promise to beef up compliance and data security measures-following the revelation earlier this year that its journalists were able to access some client terminal usage data-by hiring Paul Wood as the vendor's first chief…

Kaplan Swaps Telx for Equinix

Shawn Kaplan recently joined datacenter and hosting provider Equinix as sales director for the vendor's major accounts team covering financial services, a newly-created role leading a sales team focused on building strategic relationships with Equinix's…

Moody's, Nasdaq Sign On For CRISP Contracts

The organizations will beta test the standardized appendix for data contracts developed by a group from the FISD industry association.

HSBC Selects Avaloq for Private Banking Business

HSBC has announced it will deploy Avaloq Banking Suite across its global private banking business.

TT Goes Live on NLX and Nasdaq OMX Nordic

Trading Technologies (TT) ends the year with another link to exchange gateways, as it announces connections to two Nasdaq derivatives hubs: London-based NLX, and Nasdaq OMX Nordic.

CSD Regulation Gains Provisional Trilogue Agreement

The long-mooted EU regulation governing the operation of central securities depositories (CSDs), known in industry shorthand as CSD Reg, gained provisional agreement in trilogue yesterday.

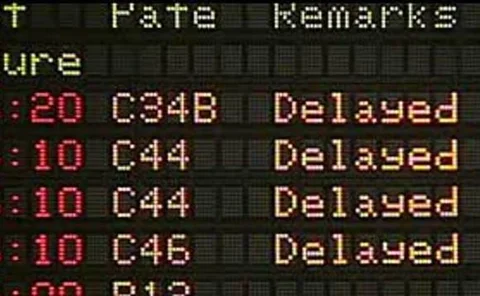

2013 Review: For Exchanges in 2013, Life’s a Glitch

US stock and options exchanges suffered such significant outages in 2013 that regulators step ped in to bring the markets to task over the failures, many of which were linked to problems with the exchanges’ ability to disseminate market data.

BayernLB Joins Eurex OTC Clear

Bayerische Landesbank (BayernLB), one of Germany's largest regional banks, has joined the EurexOTC Clear service as a clearing member for interest-rate swaps.

Thomson Reuters Launches New Autex Tool, Moves Another

Thomson Reuters has added two enhancements to its Autex FIX order routing.

Bitcoin Tanks as RMB Spigot Dries Up

BTC China, the country's largest exchange for the virtual currency, was forced to stop trading after a recent dictate handed down from the Chinese central bank and other regulators banned local financial institutions from dealing in it.

SeekingAlpha Lists OTC Markets Data, Links

Financial news, analysis and transcript website Seeking Alpha has added marketplace designations for the OTCQX, OTCQB and OTC Pink markets operated by OTC Markets Group to company information on its website, to denote the listing market of each security…

MainstreamBPO Expands DST HiPortfolio Usage

Sydney-based fund administration provider has expanded its use of DST Global Solutions' HiPortfolio product, to support large-scale growth.