News

Derwent Capital Launches Real-Time Sentiment App

"Twitter Fund" legacy continues with precursor to online trading platform.

Markit Adds Instruments, Currencies to OIS Pricing

Data vendor adds new functionalities to Portfolio Valuations service.

Fed Publishes FMU Risk Management Rules

Finalized regulation based on IOSCO-CPSS standards.

CMA Extends Connectivity and Raw Data from Brazil to New York

The Brazilian vendor allows New York firms to access market data and connectivity to the execution platform.

Markit Expands Options for Client OIS Discount Pricing

Vendor allows clients to choose pricing methodology and underlying currency for more accurate pricing

Dion Grows out of Hartmann's Back Office

As Hartmann's business changed, it was particularly interested in Invantage's reporting capabilities.

Japanese Firm Implements OneMarketData's OneTick

SBI Securities has added OneTick to its platform with the help of Intelligent Wave Inc.

Markit Introduces CVA and Capital Solution

The platform will help firms achieve Basel III compliance by calculating credit valuation adjustment and capital charges.

Questions Remain About CICI-To-LEI Transition

The Commodity Futures Trading Commission's (CFTC) choice of the Depository Trust and Clearing Corporation and Swift to provide its interim legal entity identifier (LEI) is unsurprising, but it is not yet clear how the CICI identifier will fit into the…

Old Mutual Implements FrontInvest

South African asset manager administers investments with FrontInvest platform.

LCH.Clearnet Chooses RBS's Ryan to Lead Operations

Martin Ryan joins European clearing house.

Indata Enhances IPM OMS

Firm adds integrated trade blotters and customizable functionality.

SunGard Salesman Switches to ITRS Group

Jeff Hoffman moves from SunGard's Avantgard unit to become ITRS Americas chief.

SIX Swiss Exchange and Liquidnet Expand SLS Offering

Expansion of SIX Swiss Exchange Liquidnet Service increases the number of markets covered by SLS to 11, and the stocks on offer to 4,200.

Vodafone to Manage FX with Bloomberg

Company to use FXGO platform for foreign exchange risk management.

SpryWare Rebrands MIS Components to Target Standalone Data Needs

Vendor aims to increase recognition of services beyond ticker plant and feed handlers

NYSE Appoints Nomoto as Tokyo Chief Representative

Nomoto, who specializes in derivatives, spent previous time at Société Générale, Mizuho Securities, and Barclays.

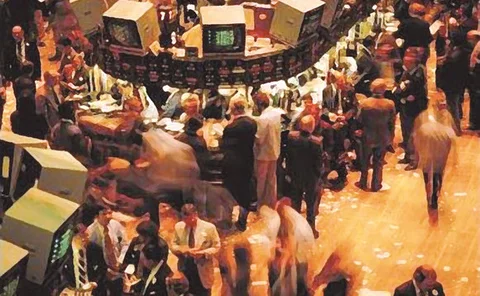

Open Outcry is Silenced at ICE

ICE will shift all options execution to its electronic platform as of October 22.