SEC

Tick Size Pilot Program Launches

The SEC's project to better understand the impact of changing the tick size for securities of small-cap companies kicks off today.

BoA Merrill Lynch Handed $12.5 Million Fine by SEC over Mini-Flash Crashes

Bank of America subsidiary fined over inadequate trading controls leading to market disruptions between 2012 and 2014.

Trump's Comments on Regulation Might Be His Most Ridiculous Yet ... Seriously

Calling for a moratorium on regulation in financial services is a bad idea, Dan says.

Waters Wavelength Podcast Episode 27: Trading Turrets, Sifma's CAT Comment Letter

Dan and Anthony talk about the future of trading turrets and Sifma's response to the CAT plan.

Pragma Targets Improved Order Routing Transparency with TradeBase Launch

Release of relational database for algo trading aimed at enhancing transparency of order routing through granular data provision.

Sifma Comment Letter Latest in Long Line of CAT Issues

The hurdles the CAT has faced stem from the SEC giving the power to SROs.

Sifma: CAT NMS Plan Has Issues with Duplicative Systems, Cost, Data Security

Industry group criticizes SROs; calls for regulatory body to resolve issues before approval of development plan.

Challenges to CAT Adoption Still Remain

One month ago, on April 27, the Securities and Exchange Commission published its plans for a mandated Consolidated Audit Trail (CAT) for public comment, along with an economic analysis of the initiative, which it estimates will cost the industry $2.4…

LEI System Ready to Take the Next Step

Direct and ultimate parent information is next for firms getting LEIs

Swaps Reporting Deadline Pushed Back

SEC grants swap data repositories a three-month extension

SEC Continue to Delay Ruling on IEX Approval, Reports Say

The SEC will use a "proceeding of disapproval" to get around IEX not agreeing to another delay, according to The Wall Street Journal.

The Industry Reacts to Dark Pool Fines

While most were not surprised by the size of the penalties, there are plenty residual effects still to be felt from the news.

Barclays, Credit Suisse Acquiesce to SEC Dark Pool Settlements

Barclays and Credit Suisse agree to pay $70 million and $84.3 million, respectively, to settle cases of misrepresentation of dark pool operations.

Spoofing: Defining the Indefinable

Dan DeFrancesco looks at the recent spoofing verdict and discusses, with some perspectives of those in the industry, why it’s such a difficult thing to define.

Citi Settles $15 Million Penalty With SEC Over Compliance, Surveillance Failures

Citi failed to properly review thousands of trades executed by several of its trading desks during a 10-year period.

ITG's $20.3 million Settlement With SEC Sets Record For an ATS

The broker agreed to settle on charges regarding the operation of a secret trading desk and misuse of confidential trading information of dark pool subscribers.

SEC Proposed Rule to Modernize, Extend Systemic Risk Reporting for Mutual Funds

Two new forms, Form N-Port and N-Cen, are at the heart of a new set of rules proposed by the SEC.

SEC’s Stein: SEC Needs Data Analysis Office

Commisioner advocates for SEC-level chief data officer to oversee data management and analysis.

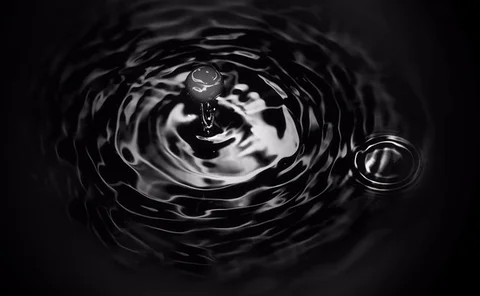

The Impact of Reg SCI

Will the SEC's newest reg have a lasting ripple effect

Azure Disruptions Show Firms Need a Plan for When Outages Occur

Abacus CTO Viktor Tadijanovic discusses having proper contingencies in place for a service interruption

SEC Votes to Strengthen Systems Compliance and Integrity

Regulation Systems Compliance and Integrity requires entities to have a plan for when systems fail.

CAT Conundrum: SROs, Vendors Vie to Build Consolidated Audit Trail

In 2012, the US Securities and Exchange Commission passed Rule 613, requesting the industry to develop a plan to build and run a platform capable of tracking and storing information on every order, cancellation, modification and trade execution for…

Liquidnet Settles SEC Case for Improper Use of Customer Data

Dark pool operator Liquidnet on Friday agreed to pay a $2 million fine to settle a US Securities and Exchange Commission (SEC) charge that the New York-based brokerage improperly used subscribers' confidential trading information in marketing its…

SEC's Berman: Let Data Allay Investors' Fears, Drive Test Pilots

Gregg Berman, associate director of the Securities and Exchange Commission’s (SEC’s) office of analytics and research (OAR), told an audience at the annual Options Industry Conference in Austin, Texas, that while distinct from the major technology…