Fed Confirms Two-Year Conformance Period for Volcker Rule

The US Federal Reserve Board (Fed) has confirmed that entities covered by the so-called Volcker Rule will have a two-year conformance period to prepare for compliance.

The announcement, made in conjunction with the Securities Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), the Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC) ameliorates concerns that firms would be forced to comply by the original enactment date of 21 July 2012.

Earlier in 2012, the regulators were beseiged by thousands of comment letters ahead of the public submission deadline, leading many industry participants to believe that a finalized rule this year is ambitious. The regulators themselves, while saying that banks must make good faith moves towards preparing for compliance, have given themselves the option to extend the deadline until 2017 if necessary, and may phase in reporting requirements earlier.

"The clarification of the Volcker Rule conformance period which was issued today is entirely appropriate and necessary," says Kenneth E Bentsen Jr, EVP for public policy and advocacy at the Securities Industry and Financial Markets Association (SIFMA). "The industry has been concerned throughout this process over what was to be expected on July 21, 2012, and that concern was heightened as it appears likely that regulators may not be able to promulgate a final rule by that date. Today's guidance that firms subject to Volcker will be able to use the full two year conformance period to come into compliance with the rule as provided for by the statute is critically important because it alleviates concerns over potentially having to comply with a rule whose details had not yet been made clear."

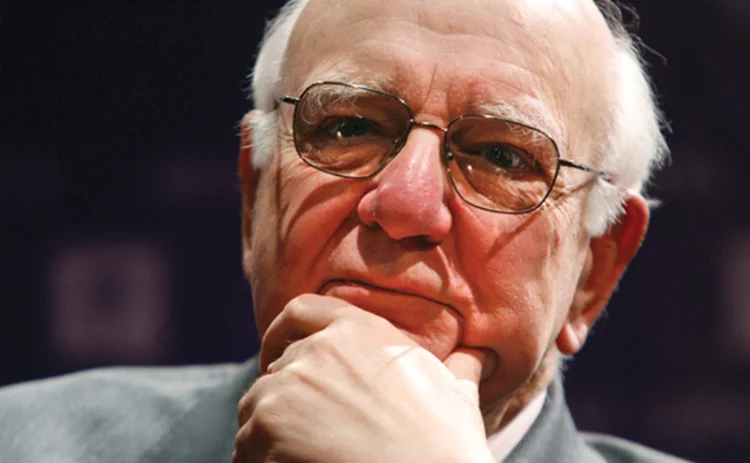

Officially section 619 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, the regulation is informally known as the Volcker Rule after Paul Volcker, the former Fed chairman and author of the original outline. Among other areas, the rule restricts the level of proprietary trading that banks can engage in, as a safeguard against systemic risks such as the bank collapses seen during the recent financial crisis.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Regulation

Sprecher says ICE will expand positioning in crypto, prediction markets

Jeff Sprecher, CEO of ICE: “We have two new [chairmen at] the SEC and CFTC that are working to try to pull the entrepreneurship in the wild west into the financial system.”

Esma won’t soften regulatory expectations for cloud and AI

CCP supervisory chair signals heightened scrutiny of third-party risk and operational resilience.

Esma supervision proposals ensnare Bloomberg and Tradeweb

Derivatives and bonds venues would become subject to centralized supervision if the proposed reforms go through.

Cyber insurance premiums dropped unexpectedly in 2025

Competition among carriers drives down premiums, despite increasing frequency and severity of attacks.

Market participants voice concerns as landmark EU AI Act deadline approaches

Come August, the EU’s AI Act will start to sink its teeth into Europe. Despite the short window, financial firms are still wondering how best to comply.

ICE to seek tokenization approval from SEC under existing federal laws

CEO Jeff Sprecher says the new NYSE tokenization initiative is not dependent on the passage of the US Clarity Act.

Why UPIs could spell goodbye for OTC-Isins

Critics warn UK will miss opportunity to simplify transaction reporting if it spurns UPI.

Re-examining Big Tech’s influence over the capital markets

Waters Wrap: A few years ago, it seemed the big cloud providers were positioning themselves to dominate the capital markets tech scene. And then came ChatGPT.