Waters

MarketAxess and DirectBooks partner, MSCI debuts AI connectors, and more

The Waters Cooler: Canton’s consortium advances cross-border collateral mobility, TRG Screen launches a market data ROI calculator, and Trading Technologies provides direct connectivity to India in this week’s news roundup.

Bloomberg Terminal’s agentic play shows rapid change in trading tech

Waters Wrap: The data giant’s conversational AI interface might seem novel, but others say having one is becoming a bare minimum in the world of trading technology.

CME rankles market data users with licensing changes

The exchange began charging for historically free end-of-day data in 2025, angering some users.

Esma supervision proposals ensnare Bloomberg and Tradeweb

Derivatives and bonds venues would become subject to centralized supervision if the proposed reforms go through.

AllianceBernstein enlists SimCorp, BMLL and Features Analytics team up, and more

The Waters Cooler: Mondrian chooses FundGuard to tool up, prediction markets entice options traders, and Synechron and Cognition announce an AI engineering agreement in this week’s news roundup.

Data heads scratch heads over data quality headwinds

Bank and asset manager execs say the pressure is on to build AI tools. They also say getting the data right is crucial, but not everyone appreciates that.

Reddit fills gaping maw left by Twitter in alt data market

The IMD Wrap: In 2021, Reddit was thrust into the spotlight when day traders used the site to squeeze hedge funds. Now, for Intercontinental Exchange, it is the new it-girl of alternative data.

Knowledge graphs, data quality, and reuse form Bloomberg’s AI strategy

Since 2023, Bloomberg has unveiled its internal LLM, BloombergGPT, and added an array of AI-powered tools to the Terminal. As banks and asset managers explore generative and agentic AI, what lessons can be learned from a massive tech and data provider?

CompatibL’s unique AI strategy pays dividends

CompatibL’s unique approach to AI and how its research around cognitive bias and behavioral psychology have improved the reliability of its AI-based applications.

Cyber insurance premiums dropped unexpectedly in 2025

Competition among carriers drives down premiums, despite increasing frequency and severity of attacks.

ICE launches Polymarket tool, Broadridge buys CQG, and more

The Waters Cooler: Deutsche Börse acquires remaining stake in ISS Stoxx, Etrading bids for EU derivatives tape, Lofthouse is out at ASX, and more in this week’s news roundup.

Market participants voice concerns as landmark EU AI Act deadline approaches

Come August, the EU’s AI Act will start to sink its teeth into Europe. Despite the short window, financial firms are still wondering how best to comply.

Ram AI’s quest to build an agentic multi-strat

The Swiss fund already runs an artificial intelligence model factory and a team of agentic credit analysts.

Fidelity expands open-source ambitions as attitudes and key players shift

Waters Wrap: Fidelity Investments is deepening its partnership with Finos, which Anthony says hints at wider changes in the world of tech development.

LSEG sees widespread uptake of its real-time managed service offering

LSEG Data & Analytics’ real-time managed service strategy sets it apart from other offerings in what is a highly competitive sector

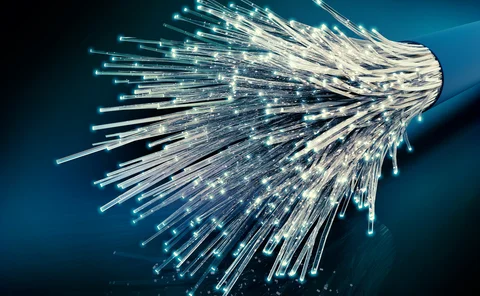

Fiber’s AI gold rush risks a connection drop

In search of AI-related profits, investors flocked to fiber cables, but there are worrying signals on the horizon.

JP Morgan gives corporates an FX blockchain boost

Kinexys digital platform speeds cross-currency, cross-entity client payments.

Achieving true front-to-back integration: Simplifying the trade life cycle

How mid-tier firms can simplify the trade life cycle and build for the future.

Data standardization key to unlocking AI’s full potential in private markets

As private markets continue to grow, fund managers are increasingly turning to AI to improve efficiency and free up time for higher-value work. Yet fragmented data remains a major obstacle.

BlackRock further integrates Preqin, Nasdaq and Osaka Exchange partner, and more

The Waters Cooler: SGX remodels data lake, ICE seeks tokenization approval, TNS closes Radianz deal, and more.

Market-makers seek answers about CME’s cloud move

Silence on the data center’s changes has fueled speculation over how new matching engines will handle orders.