Algo

Google-Greenwich: Financial firms agree on cloud's ubiquity, but vary widely on use cases

New research highlights predicted growth areas for cloud computing—and the tools it enables, such as AI and machine learning—in the capital markets. Spoiler alert: Google says cloud is becoming as ubiquitous as the search giant itself.

Waters Wrap: Cloud, AI, Interop: The evolutions driving fixed-income progress

Anthony believes these advancements will provide the opening for Big Tech firms to created outsized influence that will change financial technology forever.

Charles River, Wave Labs team up for enhanced OEMS

The strategic partnership will involve a three-part integration including system connectivity, combined visualization and the creation of client feedback loops.

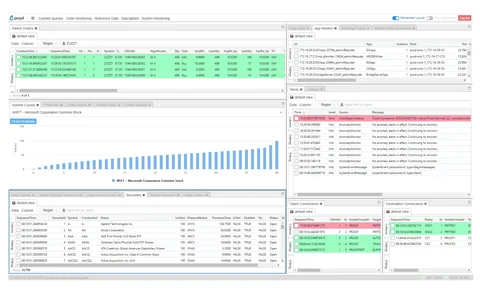

Burden of Proof: Meet the IEX breakaways looking to shake up broker algos

Founded with the principles of “transparency and academic rigor,” some say Proof’s model and technical approach is a test case for a new generation of cloud-native broker startups.

Holding Pattern: As Trading Technologies awaits new owner, the vendor adjusts development strategy

The Chicago-based futures trading platform recently rolled out a new OMS offering, while other projects, like its Echo Chamber market data platform, have been put on pause until a sale goes through.

Swedish bank finds Covid-19 recovery insights in alt datasets

High-frequency data such as human mobility data and plastic shipments can help investment professionals understand the post-pandemic economic reopening.

Regulators must find a balance with artificial intelligence

There's rapid digital transformation underway in the industry and regulators must get with the game plan while not over-regulating the use of AI.

Brown Brothers Harriman continues AI ‘transformation’ of fund accounting unit

A new tool that helps business users test and validate their own POCs is set to join the bank’s ranks alongside its other AI projects implemented over the last two years: Linc, Guardrail, and Ants.

Deep XVAs and the promise of super-fast pricing

Intelligent robots can value complex derivatives in minutes rather than hours

Banks fear Fed crackdown on AI models

Dealers say the agencies’ request for info could prompt new rules that stifle model innovation.

Deutsche Bank leverages AI for securities services

The bank’s client segmentation offering creates more targeted post-trade offerings, while its prediction engine can help reduce settlement failures.

Vanguard overhauls EU data strategy to better manage analytics, regulatory needs

The asset manager’s CIO for Europe aims to centralize responsibilities from its UK and EU offices for how its business in the region manages data and develops new investment products.

One step closer: How exchanges are seeking tighter relationships with clients

Increasingly, exchanges are trying to get closer to their customers, in a bid to better understand how they use market data. This move may come at the expense of data vendors that are being gradually squeezed out of the exchange-client relationship.

Waters Wrap: When will Big Tech providers turn sights on the market data space? (And deep learning)

In recent years, the major cloud providers have expanded their service offerings specific to capital markets firms. Some industry observers believe it’s just a matter of time until they get involved in market data M&A activity.

Inside RBC’s Aiden project: 5 years of deep learning

Aiden, a trading platform launched last year, is the product of five years of experimentation with deep learning by RBC Capital Markets on top of an additional five years of hypothesizing about what best execution would one day require.

LSEG to replatform Matching and FXall

Migration to stock exchange’s tech platform aims to deliver faster speeds and more order types.

Quandl goes live with new dataset for measuring dollar value of patents

The data vendor’s product is its first that aims to sort what it believes to be truly innovative companies from the pack.

Financial institutions battle cyber threat info overload

Cyber threat intelligence is crucial for the defense of an organization’s network, but financial firms have to figure out how to make sense of all the data first.

Engineers tap machine learning to improve graph analytics

Augmenting graph analytics with AI can detect more complicated anomalies, vendors say.

Linedata looks to modularize OMS, analytics offerings to compete in consolidating market

After releasing its cloud-native AMP and data analytics platforms in 2020, Linedata is looking to readjust its OMS strategy as it embraces microservices.

CDS trading remains stubbornly human

Buy-sider traders remain skeptical of the benefits of algo execution for credit derivatives.

This Week: Refinitiv, State Street, FlexTrade, FactSet/Microsoft, Cboe, and more

A summary of some of the past week’s financial technology news.

PanAgora’s CIO & head of sustainable investing explain firm’s ESG framework, best practices

Waters Wavelength Podcast Interview Series: PanAgora’s George Mussalli and Mike Chen hit on topics including building predictive models using point-in-time data, and balancing ESG portfolios.

Waters Wrap: Dash Financial gets nabbed by Ion (And monetizing data)

Ion Group has acquired Dash Financial. Whether or not this ends up being a good marriage will come down to the people making the tech platforms, Anthony says.