AI

The capital markets’ appetite for AI is evolving ... slowly

Nyela checks the vibe of generative AI, which is slowly evolving from frenetic conversations to tangible tools and use cases.

Waters Wrap: Quants, CDOs, and the blending of job titles

Anthony explains how a quant at a massive bank taking on the CDO title hints at larger industry changes.

Caveat creator: GenAI giants’ pledges won’t pre-empt copyright suits

Tech vendors offer indemnities on generative output, but end-users need to check the fine print, warn IP lawyers

Nasdaq to market new options strike listing tech to other exchanges

The exchange operator is experimenting with emerging technologies to determine which options strike prices belong in a crowded market, with hopes to sell the tech to its peers.

Former Goldman analyst aims to blend GenAI and synthetic data with start-up

Synthera.ai is taking a novel approach to calculating risk. While promising, industry observers are skeptical.

Waters Wavelength Podcast: Bloomberg’s Tony McManus

Tony McManus, global head of enterprise data division at Bloomberg, joins the podcast to talk about the importance of data in the context of AI and GenAI.

Putting the ‘A’ in CDO: The rise of the chief data and analytics officer

As data and analytics become more intertwined, banks and vendors are creating a new role—the chief data and analytics officer—to help them take advantage of the opportunities it presents. It may sound easy, but rethinking data can be a gargantuan task.

Waters Wavelength Podcast: S&P’s CTO on AI, data, and the future of datacenters

Frank Tarsillo, CTO at S&P Global Market Intelligence, joins the podcast to discuss the firm’s approach to AI, the importance of data, and what might be in store for datacenters in the coming years.

BMO’s cloud migration strategy eases AI adoption

The Canadian bank is embracing a more digital future as its cloud strategy makes gains and it looks to both traditional machine learning and generative AI for further augmentation.

Waters Wrap: GenAI and rising tides

As banks, asset managers, and vendors ratchet up generative AI experiments and rollouts, Anthony explains why collaboration between business and tech teams is crucial.

Ice moves to meet demand for greater cloud, AI capabilities

The exchange also outlined competitive advantages behind managing its data and cloud strategy internally during its Q1 earnings call on Thursday.

FactSet looks to build on portfolio commentary with AI

Its new solution will allow users to write attribution summaries more quickly and adds to its goal of further accelerating discoverability, automation, and innovation.

How Ally found the key to GenAI at the bottom of a teacup

Risk-and-tech chemistry—plus Microsoft’s flexibility—has seen the US lender leap from experiments to execution.

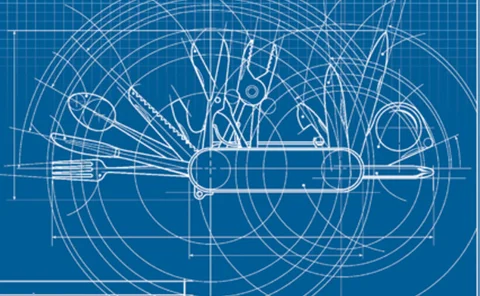

S&P debuts Spark Assist genAI copilot, draws up ‘Blueprints’ of combined datasets

S&P’s Kensho subsidiary has rolled out new emerging tech products leveraging AI to explore and combine the vendor’s wealth of datasets to solve common use cases.

Symphony boosts Cloud9 voice offerings with AI

The messaging and collaboration platform builds on Cloud9’s capabilities as it embraces the AI wave in what CEO Brad Levy calls “incremental” steps.

Waters Wrap: Open source and storm clouds on the horizon

Regulators and politicians in America and Europe are increasingly concerned about AI—and, by extension, open-source development. Anthony says there are real reasons for concern.

Waters Wavelength Podcast: Broadridge’s Joseph Lo on GPTs

Joseph Lo, head of enterprise platforms at Broadridge, joins the podcast to discuss AI tools.

Man Group CTO eyes ‘significant impact’ for genAI across the fund

Man Group’s Gary Collier discussed the potential merits of and use cases for generative AI across the business at an event in London hosted by Bloomberg.

BNY Mellon deploys Nvidia DGX SuperPOD, identifies hundreds of AI use cases

BNY Mellon says it is the first bank to deploy Nvidia’s AI datacenter infrastructure, as it joins an increasing number of Wall Street firms that are embracing AI technologies.

Systematic tools gain favor in fixed income

Automation is enabling systematic strategies in fixed income that were previously reserved for equities trading. The tech gap between the two may be closing, but differences remain.

Broadridge CEO: ‘We intend to be a leader in AI’

In 2023, Broadridge became one of the first capital markets-focused companies to roll out a GPT-powered tool. Now it is looking across use cases and foundational models to determine where to plant its flag next.

Fighting FAIRR: Inside the bill aiming to keep AI and algos honest

The Financial Artificial Intelligence Risk Reduction Act seeks to fix a market abuse loophole by declaring that AI algorithms do not have brains.

Waters Wrap: The rise of AI washing… and regulation washing?

The SEC recently levied fines against two investment advisors over “AI washing”. Anthony takes issue with the announcement.

Getting aggressive: Overbond uses AI to assess dealer axes

The fixed-income analytics specialist has developed a new tool to help buy-side firms decide if they’re getting a good price from their dealers.