AI

Study: RAG-based LLMs less safe than non-RAG

Researchers at Bloomberg have found that retrieval-augmented generation is not as safe as once thought. As a result, they put forward a new taxonomy to help firms mitigate AI risk.

Nasdaq, AWS offer cloud exchange in a box for regional venues

The companies will leverage the experience gained from their relationship to provide an expanded range of services, including cloud and AI capabilities, to other market operators.

OCC’s security chief on generative AI with guardrails

Clearinghouse looks to scale technology across risk and data operations—but safety is still the watchword.

Bank of America reduces, reuses, and recycles tech for markets division

Voice of the CTO: When it comes to the old build, buy, or borrow debate, Ashok Krishnan and his team are increasingly leaning into repurposing tech that is tried and true.

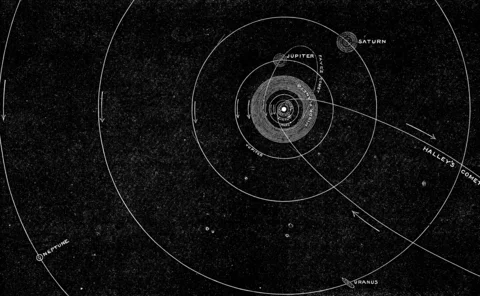

Navigating the tariffs data minefield

The IMD Wrap: In an era of volatility and uncertainty, what datasets can investors employ to understand how potential tariffs could impact them, their suppliers, and their portfolios?

Waters Wavelength Ep. 313: FIS Global’s Jon Hodges

This week, Jon Hodges, head of trading and asset services for Apac at FIS Global, joins the podcast to talk about how firms in Asia-Pacific approach AI and data.

Project Condor: Inside the data exercise expanding Man Group’s universe

Voice of the CTO: The investment management firm is strategically restructuring its data and trading architecture.

BNP Paribas explores GenAI for securities services business

The bank recently released a new web app for its client portal to modernize its tech stack.

DeepSeek success spurs banks to consider do-it-yourself AI

Chinese LLM resets price tag for in-house systems—and could also nudge banks towards open-source models.

Saugata Saha pilots S&P’s way through data interoperability, AI

Saha, who was named president of S&P Global Market Intelligence last year, details how the company is looking at enterprise data and the success of its early investments in AI.

Are we really moving on from GenAI already?

Waters Wrap: Agentic AI is becoming an increasingly hot topic, but Anthony says that shouldn’t come at the expense of generative AI.

Cloud infrastructure’s role in agentic AI

The financial services industry’s AI-driven future will require even greater reliance on cloud. A well-architected framework is key, write IBM’s Gautam Kumar and Raja Basu.

Waters Wavelength Ep. 310: SigTech’s Bin Ren

This week, SigTech’s CEO Bin Ren joins Eliot to discuss GenAI’s progress since ChatGPT’s emergence in 2022, agentic AI, and challenges with regulating AI.

A new data analytics studio born from a large asset manager hits the market

Amundi Asset Management’s tech arm is commercializing a tool that has 500 users at the buy-side firm.

Microsoft exec: ‘Generative AI is completely passé. This is the year of agentic AI’

Microsoft’s Symon Garfield said that AI advancements are prompting financial services firms to change their approach to integrating AI-powered solutions.

Inside the company that helped build China’s equity options market

Fintech firm Bachelier Technology on the challenges of creating a trading platform for China’s unique OTC derivatives market.

Waters Wavelength Ep. 308: Arta Finance’s Caesar Sengupta

Caesar, who previously spent 15 years at Google, joins to discuss Arta’s goal of putting a private banker in everyone’s pockets.

Hyperscalers to take hits as AI demand overpowers datacenter capacity

The IMD Wrap: Max asks, who’s really raising your datacenter costs? And how can you reduce them?

Banks urged to track vendor AI use, before it’s too late

Veteran third-party risk manager says contract terms and exit plans are crucial safeguards.

Asset manager Fortlake turns to AI data mapping for derivatives reporting

The firm also intends to streamline the data it sends to its administrator and establish a centralized database with the help of Fait Solutions.

A fireside chat with SmartStream’s Akber Jaffer

A fireside chat with SmartStream’s chief executive to discuss his first 15 months at the helm of the business and SmartStream Air 9.0—the firm’s new AI-driven reconciliations platform.

The murky future of buying or building trading technology

Waters Wrap: It’s obvious the buy-v-build debate is changing as AI gets more complex, but Anthony wonders how trading firms will keep up.

BlackRock tests ‘quantum cognition’ AI for high-yield bond picks

The proof of concept uses the Qognitive machine learning model to find liquid substitutes for hard-to-trade securities.

For AI’s magic hammer, every problem becomes a nail

A survey by Risk.net finds that banks are embracing a twin-track approach to AI in the front office: productivity tools today; transformation tomorrow.