AI

MSCI CEO: Vendor ‘feverishly’ infusing ‘every aspect’ of MSCI with AI

Additionally, while the vendor’s new private credit tools haven’t yet translated into outsized sales revenue, Henry Fernandez says “they will” in the future.

Experts urge banks to prep for quantum’s reckoning

Mathematicians across the world warn that current encryption methods will be crackable by quantum computers inside the current decade, but banks have been reluctant to prepare.

Franklin Templeton’s great DeFi migration

TradFi’s money and DeFi’s tech will inevitably combine, says the asset manager’s futurist-in-residence.

Bloomberg integrates AI summaries into Port

One buy-side user says that while it’s still early for agentic tools, they’re excited by what they’ve seen so far.

Examining how adaptive intelligence can create resilient trading ecosystems

Researchers from IBM and Wipro explore how multi-agent LLMs and multi-modal trading agents can be used to build trading ecosystems that perform better under stress.

Is market data compliance too complex for AI?

The IMD Wrap: Reb looks at two recent studies and an article by CJC, which cast doubt on AI’s ability to manage complexity.

LSEG unveils tick history data with AI-enhanced capabilities

Tick history data with AI-enhanced capabilities and the benefits to LSEG Data & Analytics’ clients

Can AI be the solution to ESG backlash?

AI is streamlining the complexities of ESG data management, but there are still ongoing challenges.

Banks weigh how to embed GRC in AI

Having governance, risk, and compliance at the core of AI product development will offer explainability and auditability, bank execs said.

Bank of America’s GenAI plan wants to avoid ‘sins of the past’

Waters Wrap: Anthony spoke with BofA’s head of platform and head of technology to discuss how the bank is exploring new forms of AI while reducing tech debt and growing interoperability.

Waters Wavelength Ep. 334: BofA’s Krishnan and McInnes

This week, Bank of America’s Ashok Krishnan and Duncan McInnes join Tony to discuss the build, buy, borrow strategy and instilling the right culture within the bank.

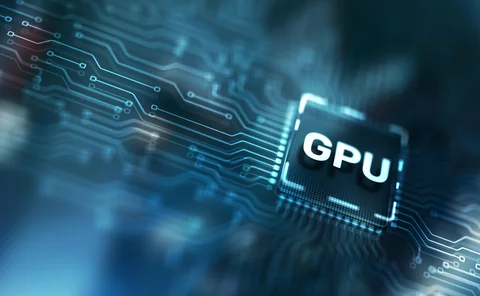

New GPU indexes to provide transparency into AI compute

Silicon Data, a company backed by DRW and Jump Trading, has launched its H100 and A100 indexes, providing transparency into the economics of AI compute.

Trust though transparency: The need for explainable AI

In this guest column, Broadridge’s Mary Beth Sweeney tells the story of BondGPT’s creation and the company’s endeavor to ensure that any user inquiries are met with traceable answers from the service.

Man Group sees alpha-generating strategies from agentic AI

The firm is seeing actionable use cases from AI agents, said CTO Gary Collier, speaking at a conference in London hosted by Bloomberg.

Expero sharpens focus on financial clients

After 20 years of delivering software, AI tools and digital UXs across industries, Expero is leaving its jack-of-all-trades strategy, aiming to become a master of one.

Chief investment officers persist with GenAI tools despite ‘blind spots’

Trading heads from JP Morgan, UBS, and M&G Investments explained why their firms were bullish on GenAI, even as “replicability and reproducibility” challenges persist.

Wall Street hesitates on synthetic data as AI push gathers steam

Deutsche Bank and JP Morgan have differing opinions on the use of synthetic data to train LLMs.

AI fails for many reasons but succeeds for few

Firms hoping to achieve ROI on their AI efforts must focus on data, partnerships, and scale—but a fundamental roadblock remains.

Fintech powering LSEG’s AI Alerts dissolves

ModuleQ, a partner and investment of Refinitiv and then LSEG since 2018, was dissolved last week after it ran out of funding.

SNB researchers test LLM-based FX trading strategy

Meta’s Llama 3.1 comes out on top at predicting G10 currency sentiment based on news articles.

Waters Wavelength Ep. 329: LLMs and the dead internet theory

This week, Reb and Tony talk about the internet and the problems compounded by AI.

Halftime review: How top banks and asset managers are tackling projects beyond AI

Waters Wrap: Anthony highlights eight projects that aren’t centered around AI at some of the largest banks and asset managers.

Swedish startup offers European cloud alternative for US-skeptic firms

As European firms look for more homegrown cloud and AI offerings, Evroc is hoping to disrupt the US Big Tech providers across the pond.

The great disappearing internet—and what it could mean for your LLM

AI-generated content, bots, disinfo, ads, and censorship are killing the internet. As more of life continues to happen online, we might consider whether we’re building castles atop a rotting foundation.