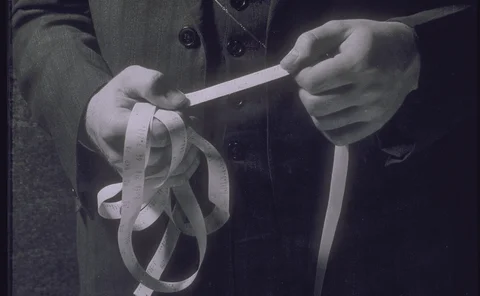

Consolidated tape

Despite regulatory thaw in US, major questions remain globally for 2026

From crypto and tokenization to the CAT to consolidated tapes to T+1’s advancement, the regulatory space will be front and center in the New Year.

Is 2027 the new 24-hour trading target?

Slew of technical issues and dearth of SEC staff compound exchanges’ reluctance for round-the-clock equity trading.

EU, US consolidated tape efforts pass important milestones

The IMD Wrap: Europe is setting up its first consolidated tapes of data, while the US is revamping its tapes into one. Both initiatives should bring greater transparency and efficiency to the capital markets.

Stakes raised for UK bond, EU derivatives tapes after Ediphy clinches win

The pressure is on for TransFICC, Etrading, Finbourne, and Propellant Digital, who are still vying to provide the UK’s fixed income consolidated tape after Esma awarded the EU’s tape to Ediphy and its partners.

No, no, no, and no: Overnight trading fails in SIP votes

The CTA and UTP operating committees voted yesterday on proposals from US exchanges to expand their trading hours and could not reach unanimous consensus.

Bond CT hopeful Etrading unveils free tape prototype ahead of tenders

The vendor hopes to provide the long-awaited consolidated tape for bonds in the EU and the UK, demonstrating its ability to do so through ETS Connect.

Big xyt exploring bid to provide EU equities CT

So far, only one group, a consortium of the major European exchanges, has formally kept its hat in the ring to provide Europe’s consolidated tape for equities.

Nasdaq leads push to reform options regulatory fee

A proposed rule change would pare costs for traders, raise them for banks, and defund smaller venues.

Is overnight equities trading a fad or the future?

Competition is heating up in US equity markets as more venues look to provide trading from twilight to dawn. But overnight trading has skeptics, and there are technical considerations to address.

FCA: Consolidated tape for UK equities won’t happen until 2028

At an event last week, the FCA proposed a new timeline for the CT, which received pushback from participants, according to sources.

As US options market continued its inexorable climb, ‘plumbing’ issues persisted

Capacity concerns have lingered in the options market, but progress was made in 2024.

Expanded oversight for tech or a rollback? 2025 set to be big for regulators

From GenAI oversight to DORA and the CAT to off-channel communication, the last 12 months set the stage for larger regulatory conversations in 2025.

FCA to publish bond tape tender details by end of January

Market participants must wait a month longer than expected for the regulator’s draft tender document, which will see several bidders vie for the chance to build the UK’s long-awaited consolidated tape for bonds.

How a consolidated tape could address bond liquidity fragmentation

Chris Murphy, CEO of Ediphy, writes that the biggest goal of a fixed-income tape should be the aggregation of, and democratized access to, market data.

Bond tape hopefuls size up commercial risks as FCA finalizes tender

Consolidated tape bidders say the UK regulator is set to imminently publish crucial final details around technical specifications and data licensing arrangements for the finished infrastructure.

The Waters Cooler: Big Tech, big fines, big tunes

Amazon stumbles on genAI, Google gets fined more money than ever, and Eliot weighs in on the best James Bond film debate.

CBOE and Aquis to make bid for European equities tape

The challenger exchanges have plans to become the second public bidder for provider of the European equities tape, following EuroCTP’s incorporation last year.

UK, EU prepare for bond tape tender as Ediphy enters fray

Competition for the role of consolidated tape provider is heating up as regulators confirm tenders to open in Q1 next year.

The IMD Wrap: Déjà vu as exchange data industry weighs its options

Max highlights some of WatersTechnology’s recent reporting on data costs and capacity issues facing the options industry, and asks, haven’t we seen this before somewhere?

Cboe pushes rule change to make way for proprietary Opra alternatives

As US options data has grown in volume and cost, Cboe says changing the public feed's governing document would make way for more competition from private alternatives, including its Cboe One Options Feed, launched in 2023.

Consolidated tape hopefuls gear up for uncertain tender process

The bond tapes in the UK and EU are on track to be authorized in 2025. Prospective bidders for the role of provider must choose where to focus their efforts in anticipation of more regulatory clarity on the tender process.