Market data

Ex-UBS Asset Management CDO takes aim at challenge of data discovery

Suvrat Bansal’s startup aims to make it easier to get data into the hands of those who need it, but who may not know it exists, faster.

From burst to bust: What happens when cloud runs dry?

After years of initial resistance, the capital markets have come to depend heavily on the compute capacity of the public cloud. But increasing market volumes are rapidly outpacing the cloud capacity that organizations thought would be sufficient for…

This Week: Deutsche Borse; State Street; IHS Markit; MSCI; & more

A summary of the week's financial technology news.

Definition of a trading venue: Reg review risks ensnarling tech vendors

Industry participants are divided over the definition of a trading venue and how regulators should revise the regulatory framework.

SimCorp takes ‘Aim’ at EDM space with DataCare rollout

Since launching DataCare in April 2020, the vendor has signed up eight clients, including Zurich Group Investment Management.

Waters Wrap: Owning the data & doing something unique with it—the ultimate alchemy

Based off of Max Bowie’s recent deep-dive feature, Anthony says that the world of alt data M&A—and the factors that drive these deals—is likely to change in the near future. For an analogy, just look to sushi.

Google-Greenwich: Financial firms agree on cloud's ubiquity, but vary widely on use cases

New research highlights predicted growth areas for cloud computing—and the tools it enables, such as AI and machine learning—in the capital markets. Spoiler alert: Google says cloud is becoming as ubiquitous as the search giant itself.

Alt data’s second inning: Brace for a long M&A game

The alternative data sector is still relatively nascent, and as such buy-side firms have struggled with how best to incorporate these non-traditional sources of information. While sources say that there will be continued M&A in the market, how those…

People Moves: WFE, MSCI, Broadway Technology, Tora and more

A look at some of the key "people moves" from this week, including Ed Tilly (pictured), who has been appointed chairman of the World Federation of Exchanges.

Waters Wrap: Some random thoughts about Big Tech disruption and M&A in Q4

Anthony looks at what he thinks will be the biggest topics during the last quarter of 2021.

Waters Wrap: Cloud, AI, Interop: The evolutions driving fixed-income progress

Anthony believes these advancements will provide the opening for Big Tech firms to created outsized influence that will change financial technology forever.

Two Sigma building quant tools to hunt real estate bargains

The information-rich market offers “trillions of dollars of opportunity”, says the firm’s data chief.

FactSet, Microsoft collaborate on voice-activated analytics

The data vendor has deployed machine learning across its ETF and fund screening datasets, and plans to interoperate with other big tech firms in the future.

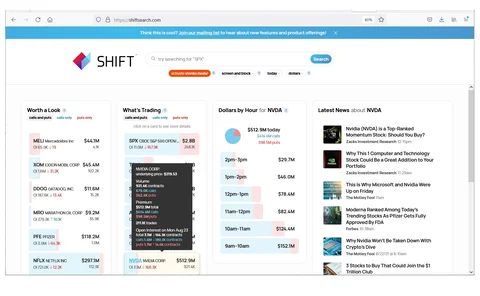

Miax preps ‘Virtual Trading Floor’ of data tools to grow investors, market-makers

The options exchange operator hopes to make it easier for participants to translate data into context and insight, and to broaden participation from new market sectors.

Waters Wrap: A whole new way of looking at data spend (And CME-Cboe thoughts)

As brokers start to explore various forms of self-service models, Anthony wonders if this could lead to a complete rethink of how commercial terms and contracts are structured for adding on new datasets.

Confusion remains over SEC’s market data efforts

Jo ponders some of the important pieces of the regulator’s National Market System modernization that remain obscure.

This Week: Azentio, TriOptima, Equinix, TNS, and more

A summary of some of the past week’s financial technology news.

‘Connect’ schemes will force Chinese buy side IT overhaul

Initiatives that provide greater access to international markets, like the Stock Connect and Bond Connect programs, will drive change at Chinese asset managers struggling with legacy trading technologies.

The market data vending machine: The pros and cons of self-service procurement

Brokers and exchanges have begun rolling out “self-service” portals that allow clients to choose data and services on an a la carte basis. Opinions vary on whether they are the Holy Grail or a poisoned chalice.

People Moves: State Street, SimCorp, Six, Exegy, and more

A look at some of the key "people moves" from this week, including Taro Kuryuzawa (pictured), who joins State Street as country head for Japan.

SEC’s CT Plan timetable is ‘unrealistic’

Implementing governance structure for new US public equities datafeeds within a year is highly unlikely, say industry observers.

Market data hopefuls await deadline with bated breath

August 9 is when regulators could approve the governance plan for the new system of datafeeds in the US. Jo says this would be an important step forward for those hoping to create new businesses under the regime.

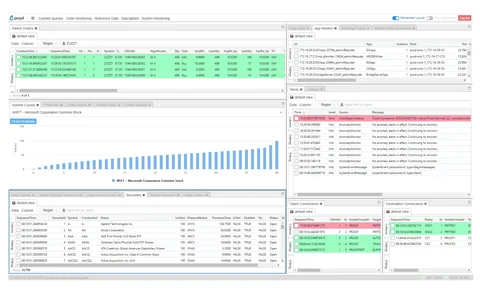

Burden of Proof: Meet the IEX breakaways looking to shake up broker algos

Founded with the principles of “transparency and academic rigor,” some say Proof’s model and technical approach is a test case for a new generation of cloud-native broker startups.

Holding Pattern: As Trading Technologies awaits new owner, the vendor adjusts development strategy

The Chicago-based futures trading platform recently rolled out a new OMS offering, while other projects, like its Echo Chamber market data platform, have been put on pause until a sale goes through.