Trading Tech

Shining a Light Into Opaque Markets Through Technology

Emilia looks at how technology has been able to bring transparency into even the most opaque of markets.

Thomson Reuters Starts Integration Drive, Equips Redi Users with Eikon Messenger

Buy-side firms get access to sell-side messaging functionality as Thomson Reuters embarks on integrating its Redi and Eikon platforms.

SimCorp Partners with OTCX for Derivatives Best Execution

Australian investment firm Merlon Capital Partners was the first SimCorp user to test the OTCX platform.

Bloomberg's Acquisition of Barclays Point: Any Port in a Storm?

Bloomberg's acquisition of the Barclays Port intellectual property has caused a storm in the fixed-income technology space for investment firms and vendors alike.

Bank of China HK joins NEX’s EBS Direct

Addition of major offshore renminbi trading bank to platform follows recent moves in China.

TGE Launches New Trading System Ahead of Harmonization Push

The Polish Power Exchange has upgraded its trading platform with new risk management and trading capabilities.

Metamako Launches Triple-FPGA Devices; Slashes Latency

The configuration enables multiple performance-sensitive applications, such as market data processing, trading algorithms and pre-trade risk checks to run on a single device.

NovaSparks Adds Bats Options Feed Support

FPGA ticker vendor claims processing speeds for Bats options markets of less than one microsecond.

June 2017: Will AI Deliver Where Blockchain Has Disappointed?

Victor says artificial intelligence (AI) has reached its tipping point, and its march forward in the capital markets is unstoppable.

Waters Wavelength Podcast 72: An Examination of the Muni Bond Market

Anthony and Emilia take a look at the municipal bond market and the proliferation of electronic platforms.

NEX to Test New Distributed-Ledger Platform

The platform, called NEX Infinity, will test reconciliation and data services for FX and cash equities.

The Muni Market’s Drive Toward Transparency—Technology Holds the Key

Regulations requiring trade data reporting has helped push municipal bond market participants to electronic trading platforms.

NAFIS 2017: Industry’s Late ‘Thaw’ on Machine Learning Leaves Much to be Done

Joanne Faulkner reports on NAFIS panelists' views on machine learning and its current and future applications for the capital markets.

Colt Adds Equiduct Connectivity

Officials say that connectivity to Equiduct─alongside the other venues to which Colt already provides connectivity─will support firms' best execution requirements while expanding Colt's regulatory services.

ESMA Preps Financial Instruments Reference Data System Launch

The Financial Instrument Reference Data System (FIRDS) will go live on July 17, 2017.

Alliance Bernstein, Algomi Partner on ALFA to Enhance Fixed-Income Market Liquidity Information

Algomi to acquire and distribute Automated Liquidity Filtering and Analytics solution in ongoing partnership with Alliance Bernstein.

Performance, Attribution and Risk Event will Address Buy-Side Middle-Office Challenges

Half-day event, sponsored by StatPro, will focus on the operational and technology challenges around transforming the middle office from a cost center to a differentiator.

NAFIS 2017: Evolving Data Science Key to Effective Data Mining

Integrating data science projects will be key for institutions to get the most out of data in the future, but skillsets and the role of data scientist teams are still evolving. Joanne Faulkner reports.

Curex Hires FX Vet Cudahy for BizDev

Cudahy will leverage his years of experience in FX sales and trading roles at various banks to make Curex "the buy side's destination for best execution."

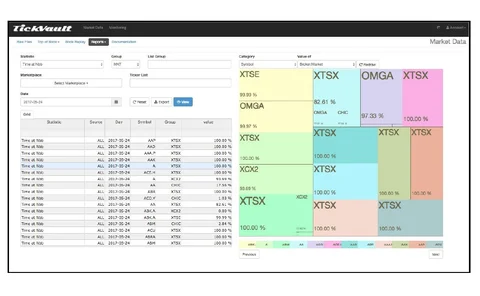

TickSmith Unveils Marketplace Analysis Tool

The new module enables market participants and exchanges to determine their performance and share of liquidity against other trading firms and exchanges.

Waters Wavelength Podcast Episode 71: Social Data, Analytics and Trading

Stephen Morse gives a presentation on how traders are using information created via Twitter to derive trading insights.

NAFIS 2017: Firms Dip Their Toes into Data Lakes for Analytics

Panelists at the North American Financial Information Summit described the transformative potential of “data lakes” for supporting firms’ ever-increasing analytics and alternative data storage requirements. Joanne Faulkner reports.

GMEX, Metropolitan Stock Exchange of India to Collaborate on Capital Markets Development

Collaboration to focus on developing existing and new products within Indian capital markets with heavy technology slant.

IHS Markit Launches Outreach360 for Mifid II Outreach and Repapering

The new platform will be available via the firm’s Counterparty Manager platform to address the need for documentation management.