Trading Tech

Euronext Continues Diversification Drive into Foreign Exchange with FastMatch Acquisition

Euronext to acquire 90 percent stake in spot FX trading network FastMatch as exchanges continue their move into investment bank domain

Alternative Data’s Hard Labor

Faye Kilburn investigates quantitative funds' attempts to sift gold from the torrent of alternative datasets.

Slowdown Showdown: Exchanges Eye 'Flash Boys' Speed Bumps

Exchanges that objected to IEX becoming an exchange are now planning to introduce their own IEX-style "speed bumps."

TickSmith Unleashes Python API for Tick Data Access

TickSmith's new Python API is aimed at the needs of data scientists using open-source Python-based analysis tools.

Are Collaborative Efforts Increasing or Is M&A Still the Trend?

Certain advancements are leading to more collaborative efforts between vendors. At the same time, M&A in the analytics space is still red hot. Anthony sorts through what this means for the industry moving forward.

BSO Offers Global Data Access to CME Co-Lo Clients

The arrangement will allow CME clients to connecto to other markets worldwide from CME's co-location center via BSO's network.

Legacy Systems, 'Army of No' Top Hurdles for Buy Side

C-Level panel identifies legacy technology and culture, deep-rooted in many firms, as the biggest hurdle to business transformation.

Waters Wavelength Podcast Episode 70: A Look at Liquidnet's Acquisition of OTAS

Adam Sussman joins Anthony Malakian to talk about Liquidnet's acquisition of OTAS, machine learning and AI, and what the buy side wants from analytics platforms.

Hybrid Legacy-Cloud Models Can Harness Potential of Older Applications in Quest for Agility

Panelists at this year’s BST European Summit in London discuss how the get the most out of the legacy technologies while also improving infrastructure through the deployment of new ones.

ChartIQ Rolls Out ‘Glue’ to Build Trading Terminal

ChartIQ describes Finsemble as "all that glue that makes everything inside a Bloomberg terminal work perfectly well with everything else.”

Indata Adds API Layer to iPM Epic Solution

Using big data technology, the Epic Data API toolkit is available to Indata users to connect systems and data sources.

State Street, TruValue Ally for ESG Data Standards

State Street and TruValue Labs have announced an agreement to promote the adoption of industry-standard ESG data.

Metamako, MayStreet Ally for High-Precision Analytics

Firms can now run MayStreet’s data analytics software on Metamako’s MetaWatch data capture and network monitoring software tool.

Modal Patterns in Market Data Stump Morgan Stanley Quants

The bank's quant team discovered strange patterns around the timing of trades that neither they--nor quants at other firms--have yet been able to explain with certainty.

Pragma Adds NDFs to Algo Trading Platform

Pragma expands its Pragma360 platform to meet growing NDF demand.

Linedata Releases New Version of Global Hedge Platform

The new version includes improved order management features and Mifid II compliance tools.

Symphony Gets $63 Million Funding Round

Officials say the investment will allow Symphony to "deliver a new wave of innovation to enterprises and replace traditional collaboration tools."

Money.Net Bolsters News Content with Dataminr, MT Newswires Upgrade

Money.Net says the Dataminr content will fill a gap in the market for social media data that is not being addressed by other terminal vendors.

Misys Releases AI Functionality for Trade Validations

The component helps financial institutions spot booking errors, anomalies and unusual activity with machine learning.

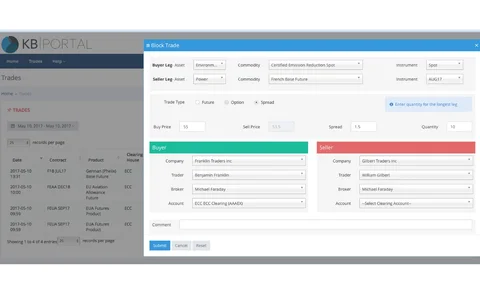

After ECC, EEX Clearing Rollout, KB Tech Eyes Data Deals

KB Tech's initial deal with ECC covers post-trade and clearing-related data, though, this may expand to other areas in future.

Waters Wavelength Podcast Episode 69: AQR's CTO, Neal Pawar, on Engineers & Open Source

Neal Pawar, AQR's CTO, joins Dan and Anthony to talk about attracting talent, the future of open source, and his love of Liverpool football club.

xCelor, Ciara Ally for High-Frequency On-Server Feed Handling, Book Building

Officials say the integration will eliminate latency associated with the processes of book-building from market data feeds.

Horizon Expands Platform with Algo Trading Templates

The new strategy templates are fully customizable, giving in-house capabilities to an outsourced solution.

Enhance Client Delivery with Artificial Intelligence: Panel

AI and automation free asset managers to do more for clients, according to panelists at Sifma Ops.