Trading Tech

Waters Wavelength Podcast Episode 74: The Regtech Craze & Clearing Concerns

Anthony and James look at why London clearinghouses may be in danger and the use of cognitive tools to monitor employees.

Looking for Questions Where the Answer Is Blockchain

Or, how I learned to stop worrying and love the distributed ledger.

Compliance Chiefs Turn to Cognitive Tech for Surveillance

Stitching together information by using cognitive tech could yield significant advantages for compliance.

Red Deer, TheySay Partner for 'Deep Text Analytics'

Red Deer will leverage TheySay’s NLP technology to help buy-side clients extract investment signals from swathes of Big Data.

Park Square Upgrades Tech in Straight-Through Processing Drive

Credit provider selects IHS Markit’s thinkFolio platform for portfolio modelling and compliance.

Hedge Fund Village Capital Partners with Ullink for Post-Trade Support

Implementation extends Village Capital's use of Ullink's XILIX EMS, which now supports a range of post-trade processes.

Calastone Tests Blockchain System for Mutual Funds Industry

Network provider successfully completed the first phase of a distributed ledger proof-of-concept test.

Thomson Reuters Releases Blockchain Smart Oracle

The Smart Oracle, called BlockOne IQ, will push external data into the blockchain.

IBM Takes Aim at Regtech Space Using Cognitive Technology

IBM marks its first major product launch in the financial services regulatory space with the roll-out of new cognitive solutions educated by Promontory professionals.

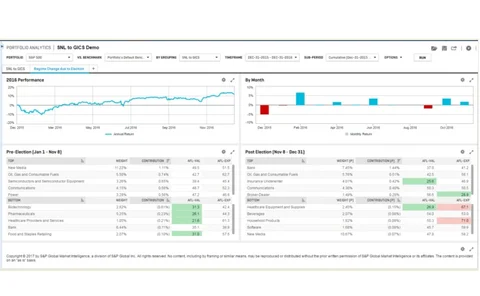

S&P Eyes Buy-Side Performance with Portfolio Analytics Tool

S&P Global Market Intelligence’s new Portfolio Analytics platform combines the vendor’s data with clients’ own proprietary content to allow portfolio managers to assess and communicate the drivers of their performance, officials tell Joanne Faulkner.

Tech Challenges Loom as Europe Eyes London’s Clearinghouses

New EU rules suggest London-based clearinghouses may be forced to relocate to the eurozone.

Net Vet Cubbon Saddles Up at Colt

Cubbon brings a career of networking technology experience, including at other financial extranet providers.

Nasdaq Launches Analytics Hub for Buy Side

Joanne Faulkner reports on Nasdaq’s new hub that allows investors to apply machine intelligence techniques to proprietary and third-party datasets to create new signals that they may not have been able to access on their own.

Northern Trust Aims to Increase Execution Transparency with New FX Algo Suite

Suite of algorithms, combined with Northern Trust liquidity panel and fee structure, to provide holistic view of FX trading process.

Thomson Reuters Integrates Eikon with Symphony

Joint customers will be able to share Eikon content directly via the messaging platform.

Brazil’s B3 Exchange Enlists Perseus for Trader Time Synch

The agreement is exclusive for an initial two-year period, and marks the first deployment of a Grand Master clock in a southern hemisphere financial center.

Sentieo Snares Carreras, Gore to Drive Data Desktop

The pair will contribute to creating new views of Sentieo's data, and to demonstrating its value to clients.

R3's Corda Enters Public Beta after HP Deal

Corda platform set for public release as R3 builds to 1.0 release.

CJC Taps Sym, Porter for US Expansion

The pair will contribute to UK-based CJC expanding its business development activities in the US

Liquidnet Unveils Tool to Help Capture Post-Block Event Opportunities

The offering adds an additional 19% of volume to the original block execution and will absorb 9 out of every 10 blocks that appear in the minute following the initial block, according to Liquidnet.

Brexit and the Buy Side

Hung parliaments are rarely a good thing for stable democracies or buy-side strategies.

Nasdaq Rolls Out Auction on Demand Service to Nordic Equities Markets Ahead of Mifid II

Nasdaq Auction on Demand is designed to address specific execution and transparency requirements for equities market under Mifid II.

IHS Markit Releases Collateral Management Solution

The vendor partnered with CloudMargin for an end-to-end cloud-based solution to calculate margins and manage disputes.

Waters Wavelength Podcast Episode 73: The UK Election, Brexit & Fintechs; The Bloomberg Point-Port Integration

An examination of what the UK election and eventual Brexit negotiations could mean for London's fintech space followed by a discussion of Bloomberg's Point-Port integration.