Sell-Side Technology/Analysis

Fair Play? The Balancing Act of Finra's Involvement in the Selection and Bidding of the CAT

The fact the Financial Industry Regulatory Authority is involved in both the selecting and bidding of the Consolidated Audit Trail has caused the regulatory body to take some heat.

Sibos 2014: Forget Bitcoin; the Blockchain's the Thing

This year's Sibos event in Boston featured a notable number of panels and speakers on the topic of cryptocurrencies. Though Bitcoin expectedly got its fair share of attention, applications of its underlying technologies may hold the greater potential.

Sibos 2014: Growing KYC Demands Have Industry Revisiting Models

Know Your Customer (KYC) screening is as far from a differentiating function as possible for banks, but bloating costs and a messy process for clients have caused a new push among the major sell sides and technology providers to build out managed service…

Symphony CEO David Gurle Discusses Goldman Sachs/Consortium Deal, New Platform

Yesterday it was announced that a consortium of 14 financial institutions led by Goldman Sachs had acquired Palo Alto-based software vendor Perzo for $66 million. The resulting acquisition led to the new company Symphony Communication Services, whose…

FSB Unveils FX Benchmark Recommendations

The Financial Stability Board (FSB) has released its final report into foreign-exchange (FX) benchmarks, where it lists a number of recommendations related to the calculation of the "fix" and trading conduct.

Shellshock Jolts Industry, Could be Worse than Heartbleed

A newly discovered vulnerability for Linux, Mac OS X and Unix-based systems highlights the challenges firms face when defending against hackers and data loss.

Sibos 2014 Keynote: Tech, Services Merge While New Barriers and Competitors Rise

This year's Sibos event, hosted in Boston, kicked off with Chris Perretta and Peter Cowhey articulating the case for a change in mindset.

Tri-party Agents Ready Ahead of Eurosystem Collateral Management Deadline

The European Central Bank’s (ECB's) initiative to reduce collateral fragmentation and operational risk across Europe has taken another step forward today as firms are now allowed to use tri-party collateral services for cross-border pledges to national…

SEF Establishment Forces Big Decisions for Sell-Side Firms

The launch of swap execution facilities (SEFs) was always going to mean tremendous change for the derivatives market. For the sell side it’s also prompted soul searching around how they differentiate themselves for institutional clients.

IT Spend Trends Toward Public Cloud

Even with limited budgets, firms are increasingly willing to invest in the public cloud.

EEX's COO Discusses TT Partnership & What's Ahead

European Energy Exchange (EEX) chief operating officer Steffen Köehler talks about how the Germany-based exchange will look to continue to grow through the use of Trading Technologies' front-end trading platform.

ECB: Eurosystem Ready for User Testing on T2S Platform

The European Central Bank (ECB) has announced that the Eurosystem is ready to begin user testing on the Target2–Securities (T2S) platform, the pan-European project aimed at providing a single system for settling central bank securities transactions.

DTCC Seeks to Expand Real-Time Submission

With an eye on moving the industry forward and increasing efficiency in trade clearance submissions, the DTCC held a forum with the NSCC and industry participants focused on how to reduce risk and streamline the process.

Taiwan Exchange Completes Deployment of Second-Generation Trading System

Trade volumes are increasing and latency is decreasing globally, particularly in the Asia-Pacific region as trading desks become ever-more sophisticated. Participants are expecting, and in many cases demanding, the ability to trade multiple markets using…

EMIR Coming Into Focus with Quieter Second Deadline

With the passing of the second deadline occurring with relative ease, firms are slowly getting a better grasp of the European Market Infrastructure Regulation, but there is still plenty of room for improvement in terms of participation, particularly…

As Prime Brokers Lack Sufficient Sales Oversight, Clients Step Up

Ultra high-net-worth (UHNW) individuals and family offices are beginning to more closely monitor the fees and servicing agreements attached to products their intermediaries are selling them. The sell side could do them one better, though, and get there…

MillenniumIT Preps Surveillance Algo Library

Market surveillance and compliance teams always have one perpetual challenge in modern markets: staying ahead of the curve.

DTCC Announces Settlement and Collateral Initiatives

The Depository Trust and Clearing Corporation (DTCC) is making an effort to publicize its primary initiatives surrounding collateral management and settlement, in an effort to help the industry lay out budgets for the coming year.

Former HP Intellectual Property Chief: Looking After IP Demands Creativity, Before Litigation

From the smallest startup to the largest financial institution, protecting the intellectual property (IP) that drives technology has become a more complicated—but also, potentially more profitable—process.

IEX Mulls Public Exchange Options

IEX, the start-up trading venue founded by former RBC trader, Brad Katsuyama, wants to institutionalize fairness and curb predatory trading by eliminating the speed advantage that high-frequency trading (HFT) firms have over smaller institutional…

Volumes an Increasing Problem for Asia-Pac Exchanges

While the world is gradually transitioning to electronic trading, critical parts of market infrastructure in Asia-Pacific are being challenged in keeping up with the increase in volumes, panelists at the Asia-Pacific Trading Architecture Summit said last…

Squeeze on Cost Changes Technology’s Role

While the pressures of cuts and budget reductions affect all areas of a firm, the technology function is experiencing a change in how it operates and the level of importance it’s given as a direct result. That was the message from panelists at the Asia…

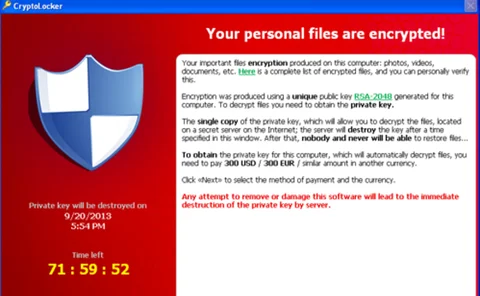

In Six Months, Ransomware Fear Has Grown

Successful cyber attacks on financial institutions have traditionally resulted in a theft of data, disruption of trading activity or websites - as in a DDOS attack - or a manipulation of internal company operations as a means of hurting the business.

BMO's Marson: Information Security Demands Processes As Well As Tools

While giving a presentation at this year's Toronto Trading Architecture Summit, Chad Marson, BMO's information security officer for capital markets, said that while security tools themselves are crucial, the processes, scalability, and ability to mature…