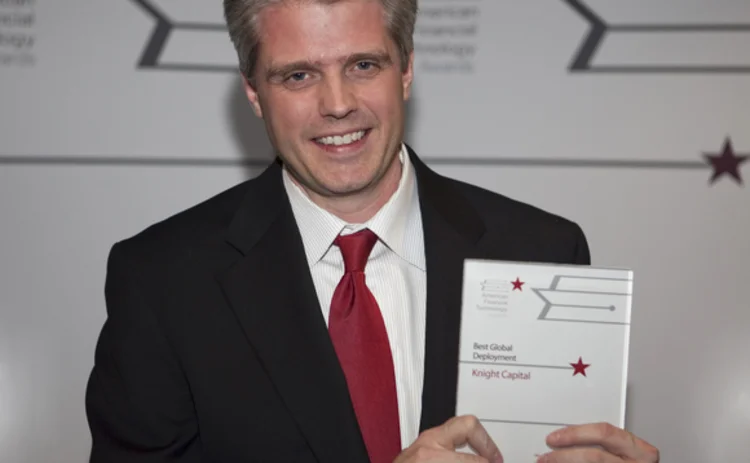

AMERICAN FINANCIAL TECHNOLOGY AWARDS: Best Global Deployment: Knight Capital

As its trading volume more than doubled over the past few years, Knight Capital saw its clearing costs grow in tandem. Combined with the financial uncertainty raised by the credit events in 2008, Knight decided to launch its own clearing business, which is estimated to save it approximately $20 million annually based on current and projected trading volumes. It also reduces counterparty risk, improves client service and opens potential new business opportunities.

Implementing a clearing platform

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Awards & Rankings

American Financial Technology Awards 2025 winner’s interview: Connamara Technologies

Connamara Technologies’ recent win in the AFTAs on the back of its EP3 platform

Buy-Side Technology Awards 2025 winner’s interview: CompatibL

The chairman of CompatibL discusses the reasons for the firm’s success in the Best buy-side AI platform category of the Buy-Side Technology Awards 2025.

AFTAs 2025: Best data provider—Allvue Systems

Product: Private Credit Intelligence

AFTAs 2025: Best IT team—TCW Group

Team: TCW Group’s Investment Technology Team; Project: Engineering Solutions—ABF and insurance launches during Aladdin stabilization

Buy-Side Technology Awards 2025 winner’s interview: 73 Strings

73 Strings’ win in the BST Awards 2025 Best middle-office platform category

AFTAs 2025: Most cutting-edge IT initiative—J.P. Morgan

Project: Vida Beta One

Buy-Side Technology Awards 2025 winner’s interview: S&P Global Market Intelligence

S&P Global Market Intelligence’s success in the first year the Best private markets data provider category has been on offer.