MSCI Barra Switches Models to Daily Data

DATA DISPLAY & ANALYTICS

Berkeley, Calif.-based risk data and software vendor MSCI Barra is moving the calculation of all of its risk models from a monthly to a daily basis, to produce more accurate estimates and meet demand from hedge funds for more frequent data.

The vendor began experimenting with daily data in 1999 and tested it with clients in 2000. However, it did not roll out any live models using daily data until 2004, the first of which were for US and Japanese equities.

Through the 1980s and 1990s—with the

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: https://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Data Management

EDM Council expands reach with Object Management Group merger

The rebranded EDM Council now includes members from industries outside financial services.

As datacenter cooling issues rise, FPGAs could help

IMD Wrap: As temperatures are spiking, so too is demand for capacity related to AI applications. Max says FPGAs could help to ease the burden being forced on datacenters.

Bloomberg introduces geopolitical country-of-risk scores to terminal

Through a new partnership with Seerist, terminal users can now access risk data on seven million companies and 245 countries.

A network of Cusip workarounds keeps the retirement industry humming

Restrictive data licenses—the subject of an ongoing antitrust case against Cusip Global Services—are felt keenly in the retirement space, where an amalgam of identifiers meant to ensure licensing compliance create headaches for investment advisers and investors.

LLMs are making alternative datasets ‘fuzzy’

Waters Wrap: While large language models and generative/agentic AI offer an endless amount of opportunity, they are also exposing unforeseen risks and challenges.

Cloud offers promise for execs struggling with legacy tech

Tech execs from the buy side and vendor world are still grappling with how to handle legacy technology and where the cloud should step in.

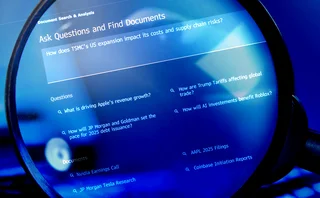

Bloomberg expands user access to new AI document search tool

An evolution of previous AI-enabled features, the new capability allows users to search terminal content as well as their firm’s proprietary content by asking natural language questions.

CDOs must deliver short-term wins ‘that people give a crap about’

The IMD Wrap: Why bother having a CDO when so many firms replace them so often? Some say CDOs should stop focusing on perfection, and focus instead on immediate deliverables that demonstrate value to the broader business.