News

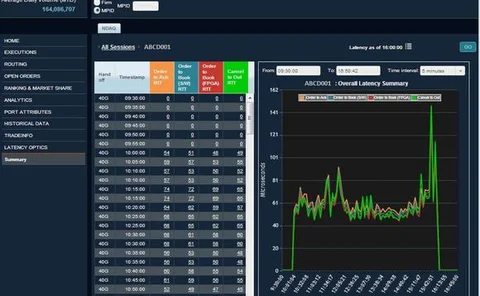

Nasdaq to Begin Displaying Customer Latency

Nasdaq OMX has partnered with Corvil, the Dublin-based latency monitoring specialist, to provide performance measurement details and diagnostic tools in the form of on-demand historical packet capture files.

Eqecat Signs Fermat Capital Management

The catastrophe modeling software vendor will provide Fermat, a $4.3 billion asset manager and specialist in insurance-linked securities (ILS), its RQE version 13 platform.

S&P's Sta. Maria Takes EMEA Role; Ordonez To Head APAC Sales

Rocco Sta. Maria of data and pricing vendor S&P Capital IQ is to move to London to head sales for Europe, the Middle East and Africa, while Jose Ordonez will replace him as managing director of sales and client services for Asia-Pacific

BNP Paribas, Clearstream Go Live with Collateral Management

BNP Paribas Securities Services and Clearstream have announced that their collateral management service for mutual clients has gone live.

Thomson Reuters Offers New Index

The "TRust Index" will provide quarterly benchmarks for 50 top financial firms, starting with the first quarter of 2013

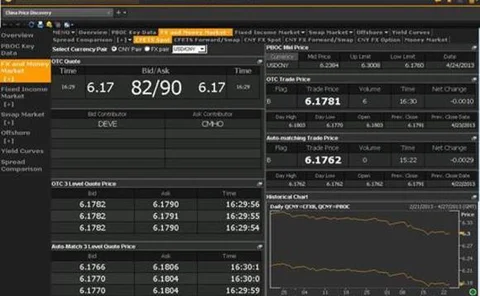

SBI Taps smartTrade for FX Order Routing and Liquidity Aggregation

SBI Liquidity Market, a Japanese foreign exchange (FX) infrastructure solution and liquidity provider, has selected smartTrade Technologies' LiquidityFX trading system to provide aggregation service and smart order routing.

Nordea Implements SimCorp's Broker Strategy Function

Nordea's Investment Management arm, which executes with an array of ten brokers, has streamlined its trading operations with the new tool, part of SimCorp's Dimension order management solution.

LEI Working Group to Improve Pre-LOU Communication; Plans for LEI Board Unveiled

A new working group is being set up to improve co-ordination between pre-Local Operating Units following concerns about duplication, and regulators have unveiled their plans for the board of directors of the legal entity identifier foundation in…

SS&C Launches Investment Intelligence

SS&C Technologies has announced the launch of Investment Intelligence, its business information tool that operates across cloud, mobile and other platforms.

Hong Kong Mercantile Exchange Joins BT Radianz Cloud

The Hong Kong Mercantile Exchange (HKMEx) has become a member of the BT Radianz Cloud network, according to an announcement from the British telecoms company.

IP Trade Integrates Red Box for Voice Recording

Trading communications system provider IP Trade has announced that it will partner Red Box Recorders, integrating the firm's technology into its own for video and voice call recording.

Deutsche Börse Combines Market Data, Tech Arms

The exchange operator's new Market Data + Services segment, headed by managing director Holger Wohlenberg, will bring together its external technology, connectivity, market data, and analytics offerings.

State Street Bolsters Collateral and Reporting Services

State Street has made enhancements to its financial reporting and collateral services to help clients comply with regulations, manage risk and automate their disclosure requirements.