European Union (EU)

Banks split over AI risk management

Model teams hold the reins, but some argue AI is an enterprise risk.

Tokenized assets draw interest, but regulation lags behind

Regulators around the globe are showing increased interest in tokenization, but concretely identifying and implementing guardrails and ground rules for tokenized products has remained slow.

Bloomberg expands GenAI summary options on Terminal

The additions include an expansion of its AI-powered news summaries, as well as a new AI summary tool for company-related news content.

SIX, ViaNexus build market data platform to unite data consumers, producers

The assets that formerly comprised IEX Cloud will underpin a new market data platform that hopes to give SIX Group and its data consumers a closer, more controlled relationship.

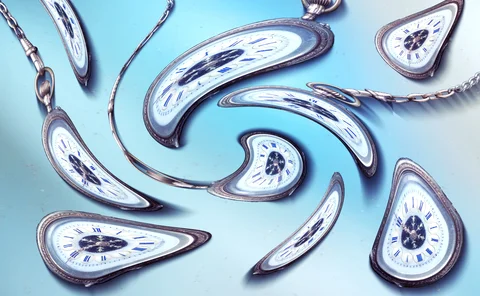

Experts urge banks to prep for quantum’s reckoning

Mathematicians across the world warn that current encryption methods will be crackable by quantum computers inside the current decade, but banks have been reluctant to prepare.

Citi gears up for EU T+1 climb

The bank has a dedicated team examining what it needs to do to ensure a successful transition to T+1 in Europe.

T+1 for Europe: Crying wolf or real concerns?

Brown Brothers Harriman’s Adrian Whelan asks how prepared the investment industry is for the changes ahead, and if concerns about its implementation are justified.

Technical and regulatory questions surround Europe’s T+1 move

The EU roadmap mirrors the UK’s goal of an October 2027 move. With more than two years to prepare, firms must consider how to implement the non-prescriptive guidelines and weigh where to automate.

EU, US consolidated tape efforts pass important milestones

The IMD Wrap: Europe is setting up its first consolidated tapes of data, while the US is revamping its tapes into one. Both initiatives should bring greater transparency and efficiency to the capital markets.

Stakes raised for UK bond, EU derivatives tapes after Ediphy clinches win

The pressure is on for TransFICC, Etrading, Finbourne, and Propellant Digital, who are still vying to provide the UK’s fixed income consolidated tape after Esma awarded the EU’s tape to Ediphy and its partners.

Doing a deal? Prioritize info security early

Engaging information security teams early in licensing deals can deliver better results and catch potential issues. Neglecting them can cause delays and disruption, writes Devexperts’ Heetesh Rawal in this op-ed.

Clearstream and SimCorp team up, Bloomberg goes dark, TT expands FX coverage and more

The Waters Cooler: Google’s AI mishaps, a new liquidity source for ASX customers, and new integrations can be found in this week’s news roundup.

Investing in the invisible, ING plots a tech renaissance

Voice of the CTO: Less than a year in the job, Daniele Tonella delves into ING’s global data platform, gives his thoughts on the future of Agile development, and talks about the importance of “invisible controls” for tech development.

Analysts cast doubt on Deutsche Börse’s tech strategy

Exchange execs countered that the company is having success moving clients from on-prem to SaaS, and expanding in the US.

Europe is counting its vendors—and souring on US tech

Under DORA, every financial company with business in the EU must report use of their critical vendors. Deadlines vary, but the message doesn’t: The EU is taking stock of technology dependencies, especially upon US providers.

Tape bids, algorithmic trading, tariffs fallout and more

The Waters Cooler: Bloomberg integrates events data, SimCorp and TSImagine help out asset managers, and Big xyt makes good on its consolidated tape bid in this week’s news roundup.

Bond CT hopeful Etrading unveils free tape prototype ahead of tenders

The vendor hopes to provide the long-awaited consolidated tape for bonds in the EU and the UK, demonstrating its ability to do so through ETS Connect.

Big xyt exploring bid to provide EU equities CT

So far, only one group, a consortium of the major European exchanges, has formally kept its hat in the ring to provide Europe’s consolidated tape for equities.

Market data woes, new and improved partnerships, acquisitions, and more

The Waters Cooler: BNY and OpenAI hold hands, FactSet partners with Interop.io, and trading technology gets more complicated in this week’s news round-up.

JP Morgan, Eurex push for DLT-driven collateral management

The high-stakes project could be a litmus test for the use of blockchain technology in the capital markets.

Big questions linger as DORA compliance approaches

The major EU regulation will go live tomorrow. Outstanding clarifications and confusion around the definition of an ICT service, penetration testing, subcontracting, and more remain.