Infrastructure

Fiber’s AI gold rush risks a connection drop

In search of AI-related profits, investors flocked to fiber cables, but there are worrying signals on the horizon.

TMX Datalinx makes co-location optionality play with Ultra

Data arm of the Canadian stock exchange group is leveling up its co-lo capabilities to offer a range of options to clients.

2026 State of trading infrastructure: How structural shifts are redefining market data and trading at quantitative firms

To better understand how firms are managing the mounting pressure on trading infrastructure, Exegy and Acuiti surveyed worldwide leaders in quantitative trading.

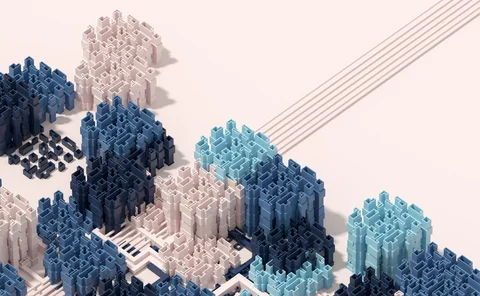

Private markets boom exposes data weak points

As allocations to private market assets grow and are increasingly managed together with public market assets, firms need systems that enable different data types to coexist, says GoldenSource’s James Corrigan.

American Financial Technology Awards 2025 winner’s interview: Connamara Technologies

Connamara Technologies’ recent win in the AFTAs on the back of its EP3 platform

Editor’s Picks: Our best from 2025

Anthony Malakian picks out 10 stories from the past 12 months that set the stage for the new year.

Despite regulatory thaw in US, major questions remain globally for 2026

From crypto and tokenization to the CAT to consolidated tapes to T+1’s advancement, the regulatory space will be front and center in the New Year.

Will overnight trading in equity markets expand next year? It’s complicated.

The potential for expanded overnight trading in US equity markets sparked debate this year, whether people liked it or not.

Citadel Securities, BlackRock, Nasdaq mull tokenized equities’ impact on regulations

An SEC panel of broker-dealers, market-makers and crypto specialists debated the ramifications of a future with tokenized equities.

TCB Data-Broadhead pairing highlights challenges of market data management

Waters Wrap: The vendors are hoping that blending TCB’s reporting infrastructure with Broadhead’s DLT-backed digital contract and auditing engine will be the cure for data rights management.

Nasdaq’s blockchain proposal to SEC gets mixed reviews from peers

Public comment letters and interviews reveal that despite fervor for tokenization, industry stakeholders disagree on its value proposition.

Jump Trading spinoff Pyth enters institutional market data

The data oracle has introduced Pyth Pro as it seeks to compete with the traditional players in market data more directly.

A cost and resource analysis on building and maintaining market data processing technology in software

The true cost of real-time market data infrastructure: Quantifying the build versus buy debate for capital markets firms (Part I)

Treasury market urged to beef up operational resilience plans

NY Fed panel warns about impact of AI and reliance on critical third parties.

Technology alone is not enough for Europe’s T+1 push

Testing will be a key component of a successful implementation. However, the respective taskforces have yet to release more details on the testing schedules.

Tokenization & Private Markets: Where mixed data finds a needed partner?

Waters Wrap: Reading the tea leaves, Anthony predicts BlackRock’s Preqin deal, Securitize’s IPO, and numerous public comments from industry leaders are just the tip of the iceberg.

Experts urge banks to prep for quantum’s reckoning

Mathematicians across the world warn that current encryption methods will be crackable by quantum computers inside the current decade, but banks have been reluctant to prepare.

DTCC revamps tech abilities following global reporting overhaul

The Repository & Derivatives Services unit is implementing new technologies to help its clients keep up with changing reg reporting regimes.

Bolsa Mexicana embarks on multi-year modernization project

Latin America’s second largest exchange is embracing cloud and upgrading its infrastructure in a bid to bolster its global standing, says CEO.

Franklin Templeton’s great DeFi migration

TradFi’s money and DeFi’s tech will inevitably combine, says the asset manager’s futurist-in-residence.

Examining how adaptive intelligence can create resilient trading ecosystems

Researchers from IBM and Wipro explore how multi-agent LLMs and multi-modal trading agents can be used to build trading ecosystems that perform better under stress.