Cloud computing

This Week: Bloomberg; Charles River, DTCC, SmartStream & More

A summary of the latest financial technology news.

This Week: Bloomberg/Google; SocGen; Aquis Exchange & More

A summary of the latest financial technology news.

This Week: Bloomberg, MSCI, Liquidnet & more

A summary of the latest financial technology news.

Eliminating the human touch: Examining RBC’s tech infrastructure evolution

The Canadian bank’s tech infrastructure unit is using Kubernetes as it looks to become a “truly end-to-end digital enterprise.”

Danske Bank turns to licensing optimization for cost savings in the millions

In a cloud world, IT asset management can save on operational and compliance costs and get the most out of software usage. But it's important to find the right people for the job.

This Week: Amundi Tech; Broadridge/ Santander; Deutsche Börse & more

A summary of the latest financial technology news.

2021: The year when Big Tech ‘Googled’ the financial markets and liked the results

Now that cloud has become widely adopted by financial firms, Big Tech companies are seeking to leverage their other services to become more ingrained in the workflows of the capital markets.

Clouding the issue: blurred lines divide banks and servicers

Banks are increasingly clashing with the big three cloud service providers over data security and configuration errors.

Slow burn to a big bang: How the new wave of tech is changing market data platforms

For decades, market data platforms have been critical components of financial firms’ trading infrastructures. But with changing user needs and emerging technologies gaining ground, will the platforms of the past be replaced by upstart challengers—or can…

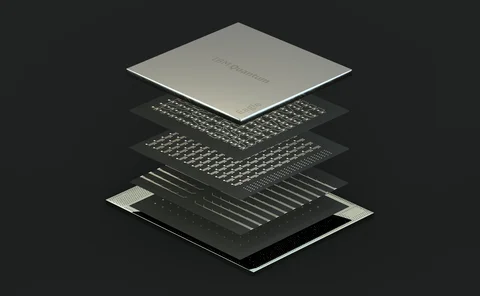

IBM eyes ‘seamless integration’ of quantum, classical computing

Blending classical and quantum computing could reduce the cost of quantum calculations and eliminate the need to understand hardware specifics, IBM says.

Disrupting data delivery: AWS Data Exchange gains ground with addition of FactSet content

Leveraging AWS’s presence on Wall Street, Data Exchange has the potential to shake up traditional financial data delivery and contracts, if it can add relevant content and overcome challenges like real-time streaming and connectivity in the cloud.

Post-trade in the cloud: Startup RQD aims to reimagine clearing

With the post-trade space poised for major change, startup clearing firm RQD says a new cloud-based platform will help it respond to client needs and new business opportunities.

Waters Wrap: CME & Google—the first domino falls

Anthony explores some of the unanswered questions—and potential ripple effects—that come with the new partnership between CME and Google.

Banks seek greater clarity from regulators on cloud risk

Regulators have been reluctant to specify cloud risks, despite warnings of overreliance on three big providers.

Waters Wrap: On cloud migrations and VCRs

Financial services firms are increasingly embracing public cloud offerings, but there have been stumbles along the way, including around scalability, throttling, and a lack of true multi-cloud connectedness. These are lessons that must be learned if…

Bank of Montreal begins 2nd phase of cloud migration and development strategy

Similar to its competitors, BMO wants the future development of financial services tools to be cloud-native. The bank expects 30% of workflows to be moved to the cloud within three years.

Google aims AI at corporate actions challenges

The tech giant believes its AI tools have a multitude of applications across some of the complex data challenges of financial markets, and it’s starting with the manual and complicated world of corporate actions. Some believe it will be an uphill battle.

From burst to bust: What happens when cloud runs dry?

After years of initial resistance, the capital markets have come to depend heavily on the compute capacity of the public cloud. But increasing market volumes are rapidly outpacing the cloud capacity that organizations thought would be sufficient for…

This Week: Deutsche Borse; State Street; IHS Markit; MSCI; & more

A summary of the week's financial technology news.

Cloud: Capital markets’ Swiss Army knife

The best uses of the cloud so far have been as an enabler of performance and innovation. The best uses yet to come could reshape AI. So, Max warns, if you think cloud is about cutting costs, you’re thinking about it all wrong.

This Week: Bloomberg, VoxSmart–GreenKey, EDM Council, Northern Trust, Anna-DSB, and more

A summary of some of the past week’s financial technology news.

Google-Greenwich: Financial firms agree on cloud's ubiquity, but vary widely on use cases

New research highlights predicted growth areas for cloud computing—and the tools it enables, such as AI and machine learning—in the capital markets. Spoiler alert: Google says cloud is becoming as ubiquitous as the search giant itself.

Waters Wrap: Cloud, AI, Interop: The evolutions driving fixed-income progress

Anthony believes these advancements will provide the opening for Big Tech firms to created outsized influence that will change financial technology forever.

Accenture wins contract for Esma’s big data analytics project

The consultancy will provide on-demand tooling for analyzing data collected from Data Reporting Service Providers.