Standards

Calypso Extends Clearing Solution to Support SEF Connectivity

Software vendor Calypso Technology has announced it has extended its over-the-counter (OTC) clearing solution for end-users to support swap execution facility (SEF) connectivity.

B-next Taps Data Vet Rhoden

Market surveillance and compliance software provider B-next has hired Mike Rhoden as product consultant, based in London, to strengthen the vendor's UK operations and expand its international client base.

DataArt Adds AIFMD Reporting to Form PF Solution

The new software enables automated filing for the alternative investment fund managers directive (AIFMD), and can also be fit into customized, back-end data integrations.

Financial IT Not Flexible Enough for Regulatory Changes, Says Waters USA Panel

Guggenheim Partners’ chief compliance officer summed up his position on adaptable IT with a question rather than a statement. “How many people think technology is flexible?” Joseph Lodato asked the audience at Waters USA. There were almost as many…

BNY Mellon Launches AIFMD Reporting Tool

BNY Mellon has launched a new reporting tool to help its fund-administration clients meet regulatory reporting requirements as stipulated by the Alternative Investment Fund Manager's Directive (AIFMD).

Financial IT Not Flexible Enough for Regulatory Changes, Say Panelists

Guggenheim Partners’ chief compliance officer summed up his position on adaptable IT with a question rather than a statement. “How many people think technology is flexible?” Joseph Lodato asked the audience at Waters USA. There were almost as many…

Tackling Symptoms and Ignoring Sources

Deutsche Bank became the latest to ban traders from chat rooms last week.

GMEX Technologies and CoDiese Release Trade Reporting Solution

GMEX Technologies, a subsidiary of London-based Global Markets Exchange Group (GMEX Group), has launched Global Reporting Company (GRC) in partnership with Paris-based regulatory advisory firm CoDiese.

Markit Selected by ASIFMA for Hong Kong Electronic Equities Compliance

The financial information provider's Counterparty Manager technology will be deployed by buy-side and brokerage members of the Asia Securities Industry and Financial Markets Association ahead of new Hong Kong Securities and Futures Commission (SFC) rules…

ICE and CME Receive Trade Repository Approvals

Intercontinental Exchange Group and the CME Group have both received regulatory approval to operate a Trade Repository (TR) for the reporting of swaps and futures trade data under the European Market Infrastructure Regulation (EMIR).

Traiana Expands Regulatory Reporting With UTI Tool

Traiana, the New York-based provider of post-trade services owned by UK interdealer ICAP, has expanded its regulatory reporting suite of solutions with a Unique Trade Identifier (UTI) management tool using the Harmony network.

ASIC Implements First Derivatives Surveillance System

The Australian Securities and Investments Commission (ASIC) has gone live with a market surveillance system from First Derivatives, the vendor has announced.

Probable Volcker Hedging Requirement to Tax Trade Capture Processes, IT

The latest round of amendments to the Volcker Rule is said to have tripled its pages, now rumored as high as 1,000. Supporters of a prescriptive approach say that isn't necessarily a bad thing. But one unresolved issue could have many tier-two sell-side…

Fonetic Adds Voice Biometrics to Record Keeping Solution

Madrid-based Fonetic has integrated voice biometrics capabilities into its solution for Dodd-Frank Title VII mandates for voice and data record keeping, incorporating them into Dodd-Frank Trading Record Keeping Compliance solution.

Open Platform: Compliance Challenges for Communications

The ways in which we all communicate have changed. The fixed-line telephone call is almost a thing of the past, with mobile and electronic communication having seen to that. Regulators have recognized this, and have told firms that they need to be…

Thomson Reuters Debuts Compliance Tool for Employee Supervision

Thomson Reuters has launched Accelus Conflicts Compliance, a web-based solution for streamlining employee supervision and code-of-conduct management, in partnership compliance specialist TerraNua.

Nice Actimize Launches Benchmark Monitoring Product

Nice Actimize has announced the debut of its Actimize Benchmark Monitoring Solution, designed to aid in the surveillance and monitoring of processes related to rate submissions such as the London Interbank Offered Rate (Libor).

Nice Actimize Partners Ullink for Trade Data

Nice Actimize has announced a partnership with Ullink, whereby data from the latter's global routing network will be used to inform market surveillance practices for the vendor's customers.

EE Partners Etrali for FCA Recording Compliance

British telco Everything Everywhere (EE) has announced a partnership with Etrali Trading Solutions to provide voice recording for clients in the City of London, as part of its wider push into the UK financial heartland.

Hargreave Hale Goes Live with Dion's Corporate Action Workflow Solution

UK stockbroker and investment manager Hargreave Hale is live on Dion Global Solutions' Corporate Action Workflow platform in order to decrease the operational risks associated with managing corporate actions.

Nasdaq Debuts iPad App for Document Management

Nasdaq OMX has launched a WorkSpace application, enabling business and document management process, for iPad.

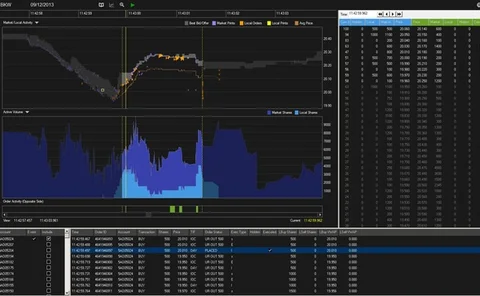

Trillium Begins Post-Trade Analytics Push

Trillium Labs, a software development spin-off from New York-based proprietary trading firm Trillium Trading has filed a patent for a new post-trade compliance monitoring tool for US equities trading that compares traders' order data to full order book…

New Regulations Will Drive Data Costs Higher, Panel Warns

The growing raft of new regulations are increasing the market data burden on all market participants for risk analysis and for meeting reporting requirements, while also increasing the cost of connecting to and aggregating new datasets, said panelists at…