Buy-Side Technology/News

Former Goldman Co-Head of Tech, Paul Walker, Joins OpenFin’s Board

Walker was at Goldman Sachs for 15 years before retiring last year.

Quantave Pushes for Institutional Processes in Digital Currencies

Startup enters closed beta with ambitions to create regulated processes around bitcoin trading.

SIX Launches Advanced Settlement After Vontobel Pilot

New system will centralize the generation and management of settlement instructions.

UPDATE: IHS Markit Partners with Deloitte for Mifid II Managed Service

Collaboration will combine IHS Markit Outreach 360 Deloitte compliance advisory services.

Park Square Upgrades Tech in Straight-Through Processing Drive

Credit provider selects IHS Markit’s thinkFolio platform for portfolio modelling and compliance.

Hedge Fund Village Capital Partners with Ullink for Post-Trade Support

Implementation extends Village Capital's use of Ullink's XILIX EMS, which now supports a range of post-trade processes.

Private Equity Firm Warburg Pincus Completes Stake Acquisition in Avaloq

The acquisition by Warburg Pincus aims to accelerate Avaloq’s long-term growth and value creation strategy.

Misys, D+H Complete Merger to Launch Finastra

Former Misys CEO Nadeem Syed to take the helm of the newly-minted software vendor following the completion of the merger between Misys and D+H.

IBM Takes Aim at Regtech Space Using Cognitive Technology

IBM marks its first major product launch in the financial services regulatory space with the roll-out of new cognitive solutions educated by Promontory professionals.

Nasdaq Launches Analytics Hub for Buy Side

Joanne Faulkner reports on Nasdaq’s new hub that allows investors to apply machine intelligence techniques to proprietary and third-party datasets to create new signals that they may not have been able to access on their own.

R3's Corda Enters Public Beta after HP Deal

Corda platform set for public release as R3 builds to 1.0 release.

Davie Returns to LCH in Rates Role

Former COO returns to clearinghouse to head up rates, compression and uncleared derivatives projects.

LiquidityBook Installs Thompson to Drive Euro Growth

New York-based LiquidityBook has appointed Nicholas Thompson as manager of its Client Services operations for EMEA, as the firm sees increased demand for its POEMS offering in the region.

Liquidnet Unveils Tool to Help Capture Post-Block Event Opportunities

The offering adds an additional 19% of volume to the original block execution and will absorb 9 out of every 10 blocks that appear in the minute following the initial block, according to Liquidnet.

IHS Markit Releases Collateral Management Solution

The vendor partnered with CloudMargin for an end-to-end cloud-based solution to calculate margins and manage disputes.

Thomson Reuters Starts Integration Drive, Equips Redi Users with Eikon Messenger

Buy-side firms get access to sell-side messaging functionality as Thomson Reuters embarks on integrating its Redi and Eikon platforms.

SimCorp Partners with OTCX for Derivatives Best Execution

Australian investment firm Merlon Capital Partners was the first SimCorp user to test the OTCX platform.

Bank of China HK joins NEX’s EBS Direct

Addition of major offshore renminbi trading bank to platform follows recent moves in China.

TGE Launches New Trading System Ahead of Harmonization Push

The Polish Power Exchange has upgraded its trading platform with new risk management and trading capabilities.

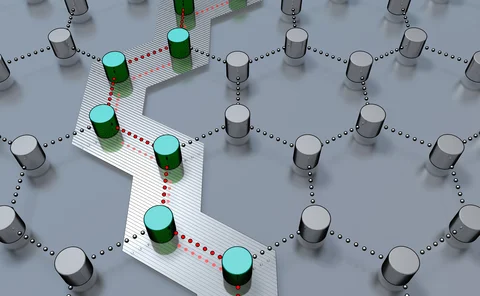

NEX to Test New Distributed-Ledger Platform

The platform, called NEX Infinity, will test reconciliation and data services for FX and cash equities.

Liquidnet Taps Takis Christias to Further Electronic Execution, Algorithmic Offering

Christias to work on trading network’s suite of execution strategies and analytics, provide quantitative research.

NICE Releases Robotic Process Automation for Compliance Investigations

Robotic process automation is seen to cut down on inefficient manual tasks.

David Quinlan to Head Business Development for Eze Software in EMEA

Quinlan joined Eze in 1999 back when the company was Eze Castle Software.

Glenmede Taps IHS Markit for Data Management

Glenmede officials say the investment firm is embarking on a “comprehensive transformation in its approach to managing data” supported by IHS Markit.