Feature

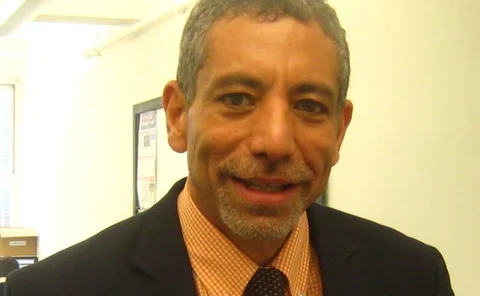

Edwin Marcial: No More Mr. ICE Guy

Edwin Marcial has been in the technology driver’s seat since before ICE’s meteoric rise. In the early 2000s, he wore the ‘upstart’ label like a badge of honor. But with the purchase of the NYSE, he doesn’t seem so comfortable with it anymore. By Jake…

Is the Low-Latency Race a Zero Sum Game?

Financial services firms will always strive to be faster and more efficient. But increasingly, the cost and risk of this evolutionary drive are proving too great for some. As a result, the ability to measure and monitor latencies across the enterprise…

IBOR Takes Hold on Buy Side

The investment book of record, or IBOR, is becoming an attractive option for buy-side firms that want a more accurate view of their portfolio positions at the start of the trading day. Nicholas Hamilton explores the options available for firms looking to…

In the Public Interest: Tech Critical as Public Investors Seek More Active Approach

A small but influential set of private equity’s limited partners, many of them quasi-public entities like pension plans and sovereign wealth funds, are considering co-investment strategies with their general partners, or even arranging deals directly…

Tech Questions Loom After Major Exchanges Tie the Knot

A period where no meaningful exchange M&A made it to the finish line has been followed by two announced megadeals that appear likely to be approved. Jake Thomases looks at what IT advantage is gained by such massive mergers, and whether these latest…

Raising Fatca Stakes

Data operations necessary for compliance with the US foreign accounts tax law, even with a delayed deadline, still need a lot of work, Michael Shashoua reports. Firms are considering the structure of their data repositories and approach to client…

African Exchange Links Could Draw Investment, Liquidity

The alliances that stock exchanges strike between themselves often turn out to be game-changers for a region’s economy. Marina Daras looks at regional initiatives to link up exchanges in one of the fastest evolving regions of the world—Africa.

Financial Industry Faces Up to Cybersecurity Challenges

While the internet has revolutionized nearly every aspect of the financial markets, it carries with it an implicit level of risk that has only recently started to be properly examined by institutional trading firms. But when it comes to cybersecurity,…

Multiples Of Utility

With confidence in outsourcing growing, Nicholas Hamilton asks whether multi-vendor utilities are the best way for third-party service providers to continue offering greater value to their clients

Solving The Data Management Puzzle

Developing data governance plans requires definitions, improvements in data quality and modeling, and consideration of authority for data operations. Michael Shashoua looks at how all these pieces may fit together

MacKay Shields Weathers Storms with Vigilante's Tech Vision

MacKay Shields has weathered some of the worst storms in recent memory, thanks to a forward-thinking approach to technology, which has been driven in part by its long-serving head of IT. By James Rundle, with photos by Amy Fletcher

US Regulators' Technology Burden

The passage of the Dodd–Frank Act in the US, while necessary, has not just stressed many Wall Street firms’ IT budgets—it has also required a substantial investment on the parts of the US regulators. Anthony Malakian charts the progress that has been…

Futures Trading Algorithms Find Traction

Equities and futures microstructures have always functioned differently—and in terms of algorithmic application, the latter has always benefited from the adventures of the former. From order placement optimization to a revived debate on pricing…

Financial Transaction Tax: Doomed to Fail?

The financial transaction tax, Tobin tax or even the Robin Hood tax—call it what you want—is here to stay. Or maybe not. By Marina Daras

Lone Wolves: Disparate Regulations, Customs Make Asia-Pacific a Tech Puzzle

With a wide array range of local conventions, regulations and customs, Asia-Pacific can be a tough nut to crack when it comes to regional expansion. Where technology is concerned, the idiosyncratic nature of its constituent nations can prove challenging,…

On the Record: Precision Engineer

As high-frequency trading took off, requiring ever-faster data distribution, latency monitoring and measurement emerged as a key part of trading firms' infrastructure strategies, and a competitive market for monitoring tools quickly sprung up. But while…

Moving Parts and Closing Gaps

Corporate actions professionals are looking at how to automate more complex pieces of processing these events, Michael Shashoua reports. Messaging standards and complex instructions and choices are key factors

Stepping Up to SEPA

The Single Euro Payments Area project is standardizing the identifiers and messaging formats used for transactions throughout the eurozone. With six months left to comply, some firms have a lot of data mapping work to do, writes Nicholas Hamilton

Europe's Build-Up to Basel III

The European Union’s Capital Requirements Directive IV will implement Basel III proposals across the continent when it comes into force at the beginning of next year. With firms likely to do much of their risk-modeling internally, the demands on data…

On the Record: Mercado Keeps it ‘Simple'

Emilio Mercado has spent the bulk of his career working for market data vendors. Now, he's working for himself, running his own vendor, Simplified Financial Information, and aiming to simplify how firms manage market data usage and infrastructure, when…

Poland's Central Clarity: CEO Iwona Sroka, KDPW Group

Dr. Iwona Sroka designed the strategy for Warsaw’s KDPW Group to reflect an operational efficiency and a future for capital markets in Central and Eastern Europe (CEE) that is increasingly bright. Strength in technology is the key. By Tim Bourgaize…

Risk Management a Challenge When Algos Go Rogue

In an article published in May, Waters explored the problematic task of performing market surveillance in automated, high-frequency trading environments. Another challenging area for algorithmic trading is that of risk management, when questions of risk…

AQR's Path to Reconciliation

In order to improve its reconciliations capabilities, AQR Capital decided it needed to replace its legacy reconciliation system, which relied largely on manual processes. The Greenwich, Conn.-based hedge fund turned to Electra Information Systems for…