Analytics

A Look Inside UBS's Quantitative Evidence & Data Science Team

Led by Bryan Cross (pictured), the asset manager's QED team aims to blend quant and fundamental to find unique solutions to new problems.

Bureau Van Dijk Rebuilds Risk Management Platform

Bureau Van Dijk's Compliance Catalyst has been rebuilt ahead of plans to move the platform to the cloud, as well as navigate the EU's fifth anti-money laundering directive.

People Moves: BMLL, DriveWealth, Blockchain, GCTA

A look at some of the key "people moves" over the past week, including Howard Surloff (pictured, right), who joins Blockchain.

Embracing the Numbers: Analytics to Improve Trader Performance

As passive strategies and fee compression cut into active returns, buy-side firms are turning to internally generated data.

Alt Data Providers Struggle To Stand Out

Adopting an optimal and sustainable business model, as well as staying on the cutting edge of analytics, are two hurdles still to be overcome by alternative data providers looking to keep their heads above water.

AlgoDynamix Pulls Trigger on ‘Magnum’ Price Forecasting Tool

The new tool captures crowding and clustering effects that can help forecast large price movements.

Luma Developing Structured Products Analytics Modules

The new modules are expected to be released in the second quarter of 2020.

FCA: UK Regtech Hype Has Cooled

The UK financial regulator is seeing fewer entrants into the industry as start-ups struggle to break into the market.

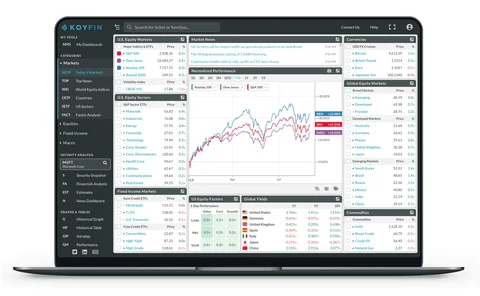

Startup Koyfin Readies New Data, Tools for Research Visualization Platform

The new features and data will form the basis of a premium, fee-liable version of Koyfin's investment researh platform slated for launch next year.

People Moves: SS&C, IEX, Quandl, Pico, ACA, Orbital Insight, Thasos

A look at some recent key people moves, including Carlo Di Florio (pictured), who joins ACA.

GreenKey To Release Front-End Dashboard For Analyzing Audio Data

The new tool, called the Blotter, will be a window into unstructured audio data as a form of operational alpha for the buy and sell sides.

ING Setting Up Fintech Spin-Off for Bond Discovery Tool

The platform, called Katana, aims to help users find fixed income investment opportunities.

FCA Working on New Data Analytics Program

The UK regulator has moved much of its data to the cloud and is using more advanced analytics as it seeks to better regulate evolving financial firms.

China’s Asset Managers See More Interest from Foreign Investors

There’s an opportunity for Chinese asset managers looking to attract foreign investors, but transparency remains an issue.

The Secret Source: Machine Learning and Open Source Come Together

A deep-dive into how capital markets firms are using open-source tools to experiment with machine learning.

People Moves: Crux, Templum, Itiviti, CFTC

A look at some of the key "people moves" over the past week, including Asif Alam (pictured), who joins Crux Informatics.

ICE Acquires Fixed Income Volatility Index from BAML

The exchange and data provider says purchase of market sentiment index from BAML is a natural next step.

Brown Brothers Harriman's Welch Explains Bank's Use of Artificial Intelligence

The bank has a number of projects using emerging technologies, one of which optimizes the process of detecting price anomalies.

DBS Bank Grows its Team of Data Translators

The bank is looking to pair this relatively new role with its data scientists as a bridge for business professionals.

Moody's Acquires Buy-Side Risk Analytics Platform RiskFirst

The deal will help Moody's expand its pension-fund footprint in the UK, and for RiskFirst to expand in the US.

Universal-Investment Explores AI to Develop ESG Services

The administrator is looking at how artificial intelligence can be used to extract online sentiment and create customized alternative data services to attract clients.

The AI Ethics Dilemma: Banks Find a Fine Line Between New Tech and 'What's Right'

Finance firms and regulators are beginning to assess the ethical implications of artificial intelligence.

UBS’s Data Lake for Regulation Pays Dividends

Waters Europe: Data requirements are driving better data for consumption across the bank.