Sell-Side Technology/News

AcadiaSoft Launches Consulting Services for Initial Margin Rules

Vendor will provide a service that advises banks and buy-side firms seeking margin-model approval from the Fed ahead of 2018 deadline

DBS Appoints Latiff as New Institutional Digital Head

Banking veteran takes on digital lead for Singapore-based bank’s institutional operations.

LiquidityBook Names Twitter Vet Andy Carroll as Chief Architect

Carroll has over 30 years of experience, most recently serving as tech lead of Twitter’s NFL live-streaming project

Euroclear and Paxos Break Up over Blockchain Project

Euroclear abandons Bankchain platform but startup says launch will go ahead in 2018

Big xyt Launches Cloud Platform Spin-off Liquidity Cockpit

Platform provides interactive analytics for both dark and lit markets and tracks large-in-scale trading activity.

Nasdaq Blends Behavioral Science and Buy-Side Surveillance with Sybenetix Acquisition

Nasdaq purchases buy-side surveillance vendor to integrate behavioral analysis into market oversight

Tradeweb Invests in DealVector to Grow Fixed-Income Suite of Solutions

DealVector has over 600,000 deals loaded on its platform across more than 1,000 firms and plans to grow that base with this investment.

UnaVista Makes Senior US Hires from S&P and NEX

LSE-owned business adds sales and marketing execs ahead of Mifid II and CAT implementation dates

Synechron Signs Calypso Implementation Deal with SIX

Synechron will train SIX employees on Calypso features to manage triparty activities.

Bats Europe Rolls out Penultimate Mifid II Exchange Upgrades

Trade reporting, order keeping and transparency capabilities enhanced by exchange group ahead of Mifid II

IBM Debuts Full Encryption with z14 Mainframe Release

IBM Z will allow for full encryption without performance disruptions to service-level agreements, IBM's Nick Sardino says.

Swift Opens KYC Registry Membership

Financial institutions can now use the registry even if they do not connect to Swift

Nigerian Stock Exchange Takes Smarts for Surveillance

The African exchange has deployed Nasdaq technology to introduce the first surveillance platform in the country.

ITG Unveils TCA Platform for Fixed Income

Fixed income expansion aimed at addressing new best execution requirements under European rules

Bloomberg Latest to Receive FCA ARM Nod

Bloomberg gets FCA approval to test transaction reporting capabilities under MiFID II

Vela Trading Continues Growth Strategy with Object Trading Acquisition

This Vela move follow’s its acquisition last month of futures and options trading specialist OptionsCity.

Icma Warns on Euro Clearing Relocation

Trade body says any forced move could increase risks and costs for derivatives users

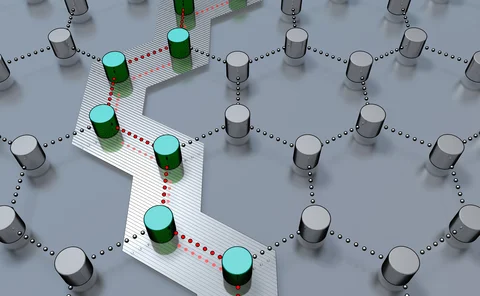

Blockchain Frameworks Move Forward with Partnerships and Production Releases

Hyperledger Fabric has released its production-ready version 1.0, as R3 partners with Intel

CLS Adds Four Currencies to Aggregation Service

Non-CLS eligible currencies from Russia, China, Turkey and Poland are the newest additions to its aggregation service.

Deutsche Börse Pumps $10 Million into Trumid

Strategic investment and partnership to drive Trumid's European expansion

Swift Targets Interbank Balances with Expanded Blockchain Pilot

Swift expands participants in project to examine blockchain's potential for making interbank payments more transparent

ICE Accepts Final CMA Verdict over Forced Sale of Trayport

ICE to end commercial agreement with energy and commodities platform, find buyer after final CMA verdict.

NEX Group Launches Dual-Regulated SEF for FX Futures

NDF trading platform will add new products and services by year-end, and is regulated by both the CFTC and FCA.

Deutsche Börse Upgrades Xetra Trading Technology in Harmonization Push

Xetra, the Deutsche Börse's German equities and European ETFs platform, has moved to the T7 equities system, aligning with Eurex.