Fixed income

Algomi Expands into Custody Market with BNY, HSBC Deals

After a rocky finish to 2016, the London-headquartered fintech firm appears to have stabilized and is looking to the future.

Illuminate Invests in TransFicc

TransFicc raises €1 million from investors including Illuminate Financial.

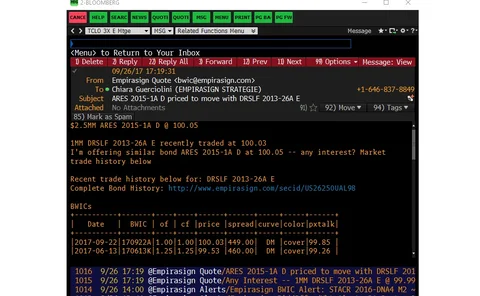

Empirasign Bows ‘Quote Builder’ Bloomberg Email Tool

The tool makes it easier for firms to create custom emails for promoting the offer of a bond to clients, by automating

SimCorp and TS Ally for OEMS Offering

Companies link workflows for execution and order management systems.

FCA Enhances Technology Firepower and Warns on Mifid II

The regulator says that it cannot create a layer of permitted compliance below European standards.

EDMA: Mifid II Driving Fixed-Income Businesses Away

EDMA warns that inconsistencies in transaction reporting are already forcing fixed-income participants to move outside the EU.

Fenics to Carry China Data from CCT-BGC

The deal provides worldwide distribution of CCT-BGC's data, while expanding Fenics' portfolio of international content.

FIIG Securities Upgrades Investment Platform with SimCorp Division

With an eye on future growth, the Australian fixed income specialist is deploying SimCorp Division across the board.

Axe Trading Targets the Buy Side with New EMS

New platform offers liquidity and venue aggregation for asset managers active in the fixed-income markets

Euronext Takes Stake in LCH’s French Clearinghouse

European exchange group Euronext has signed a deal for clearing services with LCH, scuppering a previous agreement with ICE

Neptune Adds Rabobank and TD Securities as Latest Dealers

Trading network adds banks to bring total dealer members to 24.

Tradeweb Invests in DealVector to Grow Fixed-Income Suite of Solutions

DealVector has over 600,000 deals loaded on its platform across more than 1,000 firms and plans to grow that base with this investment.

Vela Trading Continues Growth Strategy with Object Trading Acquisition

This Vela move follow’s its acquisition last month of futures and options trading specialist OptionsCity.

Deutsche Börse Pumps $10 Million into Trumid

Strategic investment and partnership to drive Trumid's European expansion

Waters Cover Profile: Improving Performance — Josh Jacobson, Cheyne Capital

John Brazier talks to Cheyne Capital COO, Josh Jacobson, about his passion for improvement through the data and behavioral analysis.

Tradeweb Connects to China’s Cfets through Bond Connect Program

Offshore platform to link with Bond Connect program, giving foreign investors access to Chinese mainland fixed-income market.

Bloomberg's Acquisition of Barclays Point: Any Port in a Storm?

Bloomberg's acquisition of the Barclays Port intellectual property has caused a storm in the fixed-income technology space for investment firms and vendors alike.

Maude Ditches Fitch for S&P

Maude joins S&P after a 20-year career in the industry, working at data vendors, marketplace operators, and brokers and asset managers.

Alliance Bernstein, Algomi Partner on ALFA to Enhance Fixed-Income Market Liquidity Information

Algomi to acquire and distribute Automated Liquidity Filtering and Analytics solution in ongoing partnership with Alliance Bernstein.

London Stock Exchange Bolsters Fixed-Income Presence with Citi Yield Book, Indices Acquisitions

$685 million deal for analytics platform and indices business first acquisition by LSEG since collapse of Deutsche Börse merger.

LSE Bolsters Fixed Income Arsenal with Citi Deal

Acquisition aims to boost FTSE Russell’s appeal to fixed income clients and “enhance and complement” LSE’s Information Services data and analytics offering.

Tradeweb’s Bruner Discusses New All-to-All Corporate Bond Trading Platform

Tradeweb enters the all-to-all space, joining companies like MarketAxess, Liquidnet and Trumid.

London Stock Exchange-Deutsche Börse Merger Killed Off by European Commission

European Commission prohibits deal on basis it would create a monopoly for fixed-income clearing in Europe.

Mifid II's Impact on Fixed-Income Trading Sharpens

From trade reporting to best execution requirements, the fixed-income market is going to change in 2018...but what that change will look like is still to be determined.