Waters

Witad Awards 2018 Write-Ups: Technology Leader of the Year (Vendor)—Bethany Baer, IHS Markit

An interesting fact about IHS Markit Digital’s CTO, Bethany Baer, is that she’s relatively new to finance. Before joining the industry on the insurance side in 2011, her most significant stint was as a vice president in various roles at travel specialist…

Witad Awards 2018 Write-Ups: Trade Execution Professional of the Year—Mariya Kurchuk, Pragma Securities

Mariya Kurchuk spent a decade studying and conducting research in the field of electrical engineering, ultimately earning a PhD in the subject from Columbia University in New York. It’s natural to think, therefore, that she’d end up at Boeing, Lockheed…

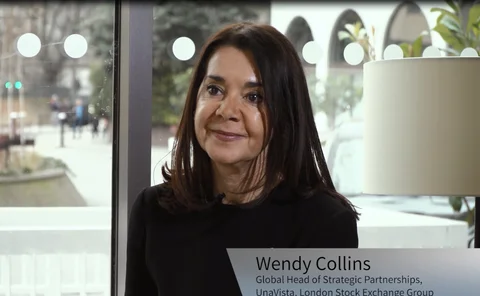

Witad Awards 2018 Write-Ups: Vendor Partnership or Alliance Professional of the Year—Wendy Collins, UnaVista (LSEG)

Wendy Collins, managing director, global strategic partnerships at UnaVista, an operating unit of the London Stock Exchange Group (LSEG), wins this year’s vendor partnership or alliance professional category, thanks to her contribution to establishing…

Witad Awards 2018 Write-Ups: Trailblazer (Lifetime Achievement)—Debra Walton, Thomson Reuters

Debra Walton, global managing director, customer proposition, financial and risk at Thomson Reuters, is the first recipient of one of the two highest-profile awards of the Women in Technology and Data Awards, the other being WatersTechnology’s woman of…

Witad Awards 2018 Write-Ups: WatersTechnology’s Woman of the Year—Sallianne Taylor, Bloomberg

Sallianne Taylor, Bloomberg’s head of strategic alliances in the firm’s global data group, wins this year’s highest-profile award due in no small part to her astonishing 30-year career at the firm. She currently manages Bloomberg’s strategic…

Waters Wavelength Podcast Episode 115: The CME Buys NEX Group

Anthony and James discuss the potential ripple effects stemming from this latest deal in the fixed-income space, fintech investment and Brexit.

Witad Awards 2018 Winner's Interview – Jennifer Peve, DTCC

The DTCC's Jennifer Peve, co-head of the firm's Office of Fintech Strategy, won the technology innovator of the year (vendor) category at this year's Women in Technology and Data Awards.

Witad Awards 2018 Winner's Interview – Wendy Collins, UnaVista

UnaVista's Wendy Collins, managing director of global strategic partnerships, is the first recipient of the vendor partnership or alliance professional category at the Women in Technology and Data Awards.

Prop Shops Lock On to Crypto Markets

As the sell side hesitates, advanced principal trading shops are getting in on the crypto craze in a big way.

Witad Awards 2018 Winner's Interview – Hella Hoffmann, Thomson Reuters

Hella Hoffmann, a data scientist at Thomson Reuters Labs, won the rising star (vendor) category at this year's Women in Technology and Data Awards held on the afternoon of March 9 in London.

Witad Awards 2018 Winner's Interview – Aouda Bellout, Schroders

Schroders' Aouda Bellout won the reference data professional of the year category at this year's London-hosted Women in Technology and Data Awards held on March 9.

Witad Awards 2018 Winner's Interview – Jennifer Keser, Tradeweb Markets

Tradeweb's Jennifer Keser won the legal/compliance professional of the year category at this year's Women in Technology and Data Awards held in London.

Witad Awards 2018 Winner's Interview – Sallianne Taylor, Bloomberg

Bloomberg's Sallianne Taylor won the final category of this year's Women in Technology and Data Awards in London - the woman of the year award.

Utility Belt: How Utilities are Stepping Up

Banks, looking for ways to cut costs and meet regulatory pressures, are increasingly turning to collaborative projects like utilities.

Witad Awards 2018 Winner's Interview – Georgia Prothero, Schroders

Schroders' Georgia Prothero won the EDM professional of the year category at this year's Women in Technology and Data Awards held in London.

Witad Awards 2018 Winner's Interview – Debra Walton, Thomson Reuters

Thomson Reuters' Debra Walton won the Traiblazer (lifetime achievement) category at the inaugural Women in Technology and Data Awards.

Waters Wavelength Podcast Episode 114: A Recap of FIA Boca - Blockchain, Crypto, AI, Brexit

WatersTechnology attended the Futures Industry Association's annual conference in Boca Raton, Florida. These are the takeaways.

Waters Wavelength Podcast Episode 113: IBM's Lund on Blockchain's Evolution

Jesse Lund talks about real uses for DLT in the capital markets, lessons learned while rolling out IBM's blockchain platform, and what’s ahead for 2018, and into 2019.

The Insurgents: Fintechs Are Knocking Off Incumbents

Anthony Malakian says that in just the first two months of 2018, some big headlines are proving just how effective fintechs are at competing with the big players in the capital markets space.

The Right Place at the Right Time

Technology can’t solve all of the market’s problems. But sometimes events can conspire to make it seem like it can. James warns on the propensity among technologists to believe in false prophets.

Waters Wavelength Podcast Episode 112: A Look at How Fintechs are Being Disruptive

The past two weeks have seen some major announcements that point to fintechs being even more disruptive than in years past.

Women in Technology and Data Awards 2018 – All the Winners

The winners of the 24 categories making up this year's Women in Technology and Data Awards were announced on Friday March 9 at a luncheon in London.

Asia’s New Tigers: Exchanges Overhaul Aging Systems

Waters looks at major projects being rolled out in 2018 at exchanges in Japan, Australia, Hong Kong and Singapore.

The Big Crunch: Traditional Tech’s Great Contraction

Waters examines how this recent wave of consolidation is different than previous periods of contraction.