Price

Traders Urge Caution on Potential Bitcoin ETFs

Senior industry figures say it may be too soon to create financial products based on cryptocurrencies.

Thomson Reuters Embarks on Cloud Content Strategy to Boost Data Access

Enhancing its Elektron Data Platform to include data on the cloud and embedding data into SAP’s Market Rates Management platform are the first steps of Thomson Reuters’ cloud strategy.

Best Evaluated Prices Service Provider: Bloomberg

IMD/IRD Awards 2018

Best Market Data Newcomer (Vendor or Product): Barchart

IMD/IRD Awards 2018

Contract Win of the Year: Bloomberg

IMD/IRD Awards 2018

SGX-NSE Battle Could Become a Long War

The exchanges are currently undergoing arbitration regarding the launch of SGX’s new futures contracts meant to succeed the outgoing SGX Nifty 50 suite of products.

Singapore Exchange Hits Back at India’s Data Pull

Indian market regulator Sebi is terminating its three exchanges’ existing market data licensing agreements with foreign partners.

Bond Trading Takes Steps to Resolve Voice and Screen Conflict

With Mifid II's deadline in the rear-view mirror, Hamad Ali gives a "State of the Union" for the fixed-income market and electronic trading platforms.

Liquidnet Adds Enhancements to Algo Suite

New algorithms let traders seek out additional block liquidity.

FCA Extends Oversight of UK Asset Management Sector

Regulator sets new obligations for senior managers and focuses on investor costs.

Bloomberg Debuts E-Bond Platform in Mauritius

Vendor developed the trading and market surveillance system in collaboration with the Bank of Mauritius and local partners.

QI, Predata Ally to Create Predictive Macro Analytics

Quant Insight is collaborating with Predata to offer a macro view that allows traders to develop strategies based on world events and market drivers.

Bloomberg Unleashes 'Kungfu' on Chinese Dollar Bond Market

The data provider will continue developing new tools and will also be rolling out analytics tools for the offshore dollar Chinese credit market.

After Delays, Esma Publishes Double Volume Cap Data

European regulator sends a message to the market that Mifid II will be enforced with this data release, experts say.

EDI ‘Solves’ for Real-Time Fixed Income Pricing

The alliance will provide real-time data parsed from client communications and submitted by market participants.

After Building an AI Black Swan Detector, Compellon Mulls Path Forward

The California-based company has built a quantitative analysis engine using machine learning to help score sell-side analysts and search for potential black-swan events.

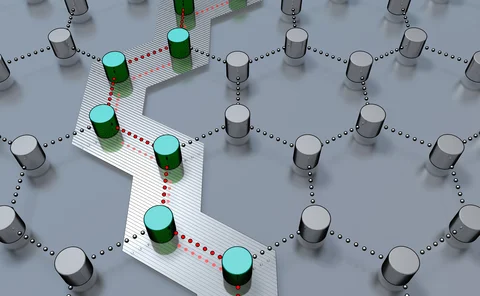

Vanguard and Symbiont Ally on Blockchain Project

With CRSP, the pilot will bring index data immediately to asset managers' networks.

Bitcoin Futures Surge on Launch, Trigger Circuit Breakers

Trading in the world’s first bitcoin futures began on Cboe Futures Exchange (CFE) last night, triggering market circuit breakers twice as investors piled on, causing the spot price of bitcoin to jump by more than $2,000 amid lingering concerns about the…

Open Platform: Starting Blocks and Auction Blocks - The Importance of a Strong Start and Finish in Setting Prices

Oliver Albers, vice president of Global Information Services at Nasdaq, argues the case for the value of opening and closing auction processes, and the value of the data they create.

LiquidityEdge Launches Off-the-Run Treasury Bond Trading

Barclays and Credit Suisse have signed up as liquidity providers.

Vietnam’s Saigon Securities Taps Horizon for Warrants and Futures Market-Making

The solution will help Saigon Securities build liquidity of its covered warrant products, and allow it to deal with the complexities around T+2 settlement.

CME Brings Bitcoin into Mainstream with Futures Launch

Exchange giant takes a major step in developing a derivatives market for the controversial commodity.

Cürex to Add Pre-Trade Market Check Time Stamp Capability

The feature will be made available to FX trade confirmations and end of day reports for best execution.

Axe Trading Targets the Buy Side with New EMS

New platform offers liquidity and venue aggregation for asset managers active in the fixed-income markets