Max Bowie

Max is editor-at-large at WatersTechnology, based in Infopro Digital's New York office.

Max joined then-Risk Waters Group (prior to its acquisition by Incisive Media) in 2000, and has worked as a reporter on Risk Magazine, FX Week, Trading Technology Week (now Sell-Side Technology) and Buy-Side IT (now Buy-Side Technology), before joining Inside Market Data as European reporter in 2003. He moved to New York as US reporter in 2005, and became editor in 2006. He was a contributor to sibling Inside Reference Data, and was founding editor of Inside Data Management, which merged the IMD and IRD newsletters into a monthly glossy magazine.

Follow Max

Articles by Max Bowie

Rimes Taps Markit’s Scott to Head EMEA, Asia Sales

Scott has 20 years of industry experience, starting at middleware vendors and most recently in EDM sales at IHS Markit.

YCharts Adds Crypto Data to Analysis Platform

YCharts is the latest vendor to wade into provision of cryptocurrency data, noting the challenges of cryptocurrencies' lack of fundamental data.

Barchart Names former GlobalView, FutureSource Exec Harrison CTO

Harrison has 25 years of experience in technology leadership roles in the market data and startup industries.

Thomson Reuters, MarketPsych Unveil Sentiment Index Update, Adding Bitcoin Data

The vendors are monitoring additional sources of news and social media specific to cryptocurrencies.

QuasarDB Taps Tech Sales Vet Jones for EMEA BizDev

Jones has more then 30 years of experience in technology sales and product management roles in Europe and the US.

S&P Shuffles Execs Following Divisional Restructure

After a New Year restructure that spun Platts out of S&P Global Market Intelligence as a separate, standalone division of S&P Global, the vendor has announced senior executive changes within the GMI division.

Nasdaq Sues IEX for Trading, Data Patent Infringements

Nasdaq's lawsuit alleges infringement of a number of patents covering its trading process and certain data elements by IEX.

SenaHill Taps Industry Vets Korhammer, Weil to Head Markets, Info Providers Sectors

Korhammer is best known for founding electronic equities trading platform Lava Trading, which was acquired by Citigroup.

SIPs Publish Historical Consolidated Tape Revenue

Officials say that making the new data available is part of continuing efforts to increase transparency around the SIPs.

RegTech Vendor Ascent Tech Gets $6M Funding, Adds CME Ventures Vet to Board

The vendor will use the funding to improve its RegTech automation engines and hire more staff.

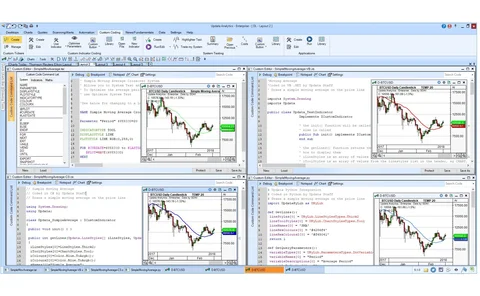

Updata Charms Python Developers for Charting Tools

By making its charting tools compatible with Python, Updata will enable users to run proprietary code and third-party Python libraries in Updata's desktop.

OneZero Adds Cboe Top Feed for Co-Lo Clients

The Cboe Top Level 1 feed will now be available to clients of OneZero's co-location environment.

QuasarDB Uses Funding to Open New York Office

The new office follows a recent $2.5 million funding round to expand its US operations.

Guardian Taps NeoXam for Data Management

Officials say Guardian will be able to eliminate a number of "cumbersome" data management and compliance processes as a result of implementing NeoXam's solutions.

February 2018: See You in Court

With compliance and collusion both under the microscope, Max says law courts could play a bigger role in ensuring a healthy and competitive data marketplace.

Hard Labor: Dealing With Alternative Data

Everyone’s excited about the potential untapped alpha promised by “alternative data,” yet those who work with it are far from excited about the prospect of evaluating unwieldy and unstructured datasets. Max Bowie looks at the practical challenges of…

Former Macrobond Sales Director Eklund Joins Buy-Side Startup Limina

Eklund, who previously spent seven years at Swedish data vendor Macrobond Financial, will play a key role in Limina's global expansion plans.

Thomson Reuters LPC, DealVector Ally for Bond Messaging

The integration will give LPC clients access to liquidity on DealVector's platform, and give DealVector clients access to data adn news from LPC.

Platts Builds Blockchain Oil Supply Data Collection Network

The Blockchain network will capture and aggregate oil inventory data and distribute it to clients and the local regulator.

EDI ‘Solves’ for Real-Time Fixed Income Pricing

The alliance will provide real-time data parsed from client communications and submitted by market participants.

Network Vet Ellis Joins Wave2Wave from Ciena

Ellis has almost 20 years of systems engineering experience in secure, low-latency microwave networking.

BNP Paribas Asset Management Names First CDO

Bonnefoux, a long-time consultant at Accenture, Ernst & Young, and Arthur Andersen, will have overall responsibility for all aspects of data strategy and quality.

Open Platform: A Data Edge in the Cloud Age

OneMarketData's Louis Lovas outlines the key concerns facing firms considering migrating data management functions to a cloud environment.

Screen Opens Singapore Datacenter to Host InfoMatch for Asia Clients

The Singapore facility will allow Screen to better serve InfoMatch clients in the region, as well as to expand the range of services it can offer locally.