Hedge funds

Systematic or Discretionary: Point72’s Granade Says Lines Are Blurring

At Waters USA, the chief market intelligence officer of hedge fund Point72 discussed how tech and data are disrupting traditional ideas about investing.

Banks Begin Exploring Homomorphic Encryption Use Cases (Part 2)

Josephine Gallagher explores some of the real-life applications of homomorphic encryption in development and the main roadblocks to its adoption.

TradingScreen Looks to Asia, New Order Management Products for Growth

The EMS provider is looking to build out its suite of solutions for the buy side, including a new algo wheel and visualization tools.

Alt Data Providers Struggle To Stand Out

Adopting an optimal and sustainable business model, as well as staying on the cutting edge of analytics, are two hurdles still to be overcome by alternative data providers looking to keep their heads above water.

QuantConnect Wants to Create a ‘League’ for Algo Testing

The crowd-sourced trading platform is looking to create a competitive arena for quants to test their algorithms.

Battle Bots: Charting AI’s Next Phase in the Back Office

Financial services firms are deeply entranced with artificial intelligence (AI), yet the revolution is under pressure as the industry continues to become more educated and selective about it. Recent research data from WatersTechnology and SmartStream…

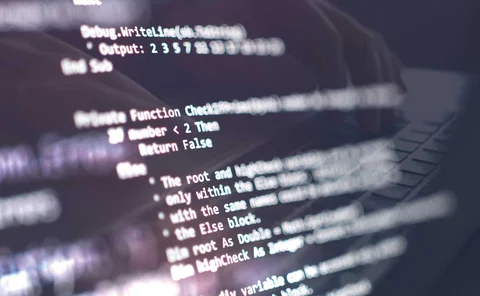

The Secret Source: Machine Learning and Open Source Come Together

A deep-dive into how capital markets firms are using open-source tools to experiment with machine learning.

Real Estate as a Tradeable Asset Class Faces Data Hurdles

The value of real estate markets dwarfs other asset classes, but a lack of data has hindered its development. Part 1 of a 2-part series.

Machine Learning Takes Aim at Black-Scholes

Quants are embracing the idea of ‘model-free’ pricing and deep hedging.

Satellite Images Drive Climate Conversations

Investment firms are turning to pictures from the sky to understand environmental impacts for alpha generation.

Outsourcing Takes to the Front Office

Fee compression and regulations have forced some asset managers to rethink what is core to their business, including the trading desk. Enter the outsourced trading desk.

Refinitiv Adds to Buy-Side Offering with AlphaDesk Acquisition

The deal lets the vendor add OMS functionality to its existing trading workflow.

Geopolitical Risk Data Moves from Foreign Intelligence to Fund Management

As nations and markets become increasingly interconnected, geopolitical risk has become top of mind for portfolio managers.

HPR Rolls Out Centralized Trading Infrastructure CRM-X

CRM-X uses cloud-like technology to trade and consolidate capital across markets.

A Blueprint for Alternative Data in Asset Management

UBS Asset Management’s data chief sets out his recommendations for using alternative data in the investment process.

Vendors Prep for Initial Margin Big Bang

Tech providers are emerging from all corners as the final phases of initial margin rules closes in, which are expected to capture over 1,000 buy-side and sell-side firms over the next 18 months.

Lucena-WSH Alliance Broadens Buy-Side Exposure to Quant Event Data Signals

Lucena will provide a pre-packaged signal based on Wall Street Horizon's earnings dates revision data, for buy-side firms without the in-house resources to analyze the raw data themselves.

5G Networks: Information Overload

Despite what some wireless carriers say, we’re still a few years away from a mass rollout of true 5G networks. While they will be revolutionary, right now it’s more hype than reality. WatersTechnology tries to look ahead to see how capital markets firms…

The Best Longform Stories of 2018

Collating the best of our features throughout the year.

XTRD Takes Avelacom for High-Speed Crypto Networks

The physical infrastructure will enable faster connectivity to global locations.

Deep Learning: The Evolution is Here

Advancements in AI have led to new ways for firms to generate alpha and better serve clients. The next great evolution in the space could come in the form of deep learning. WatersTechnology speaks with data scientists at banks, asset managers and vendors…

OpenGamma Sets US Expansion

The company will expand to the US as regulatory changes are putting pressure on costs for clients.

BCS Launches Synthetic Prime Brokerage Services

The offering will enable easier access to the Russian equity and derivatives markets.

Independence Day: Separation Brings Value for Fintech Spinoffs

Financial firms with a data or technology ‘vendor’ arm developed in house are finding that separation can benefit both business lines. Max Bowie speaks to companies that have spun out from other organizations about the good, the bad, and the ugly aspects…