Bond

Euroclear Invests in Algomi

CSD expects to increase client transaction volumes in illiquid fixed-income securities.

Taking Research to the Next Level

IMD/IRD Awards 2018 Winners' Circle

Contract Win of the Year: Bloomberg

IMD/IRD Awards 2018

Best Market Data Provider (Broker): TP Icap

IMD/IRD Awards 2018

Former MarketAxess Exec Eaton Takes Reins at Algomi

The fixed-income specialist has been appointed to the chief executive role at the fintech firm.

ICE Buys TMC Bonds for $685 Million

The exchange has acquired the trading platform as it continues to pick up fixed-income assets.

Bloomberg Debuts E-Bond Platform in Mauritius

Vendor developed the trading and market surveillance system in collaboration with the Bank of Mauritius and local partners.

Bloomberg Unleashes 'Kungfu' on Chinese Dollar Bond Market

The data provider will continue developing new tools and will also be rolling out analytics tools for the offshore dollar Chinese credit market.

Neptune Networks Looks to Expand into MBS/ABS in the US

The bond market utility now has 24 banks fully live on the platform with another two set to go live by early Q2.

Thomson Reuters LPC, DealVector Ally for Bond Messaging

The integration will give LPC clients access to liquidity on DealVector's platform, and give DealVector clients access to data adn news from LPC.

Saxo Capital Markets Launches 'Essential' Offering in Singapore, with Further Asia Expansion to Follow

‘Essential’, which is targeted toward the retail space, was first launched in the UAE & UK. Saxo will launch SaxoTraderPRO in Asia for hedge funds in April.

HKEx to Deploy Orion Trading System on February 5

The exchange is planning a series of investments in its technology this year, including a clearing platform.

Neptune Speaks to Bond Liquidity with Symphony Integration

Neptune network embeds Symphony chat functionality to boost communications and trade workflows.

LiquidityEdge Launches Off-the-Run Treasury Bond Trading

Barclays and Credit Suisse have signed up as liquidity providers.

Not Everyone’s a Convert for Fixed Income’s Move to Screen

Panelists at Risk USA discussed electronification’s slow advancement in fixed income, and debated just how necessary it is.

ICE Extends Fixed-Income Portfolio with Virtu BondPoint Acquisition

ICE acquisition follows deal for BAML's global research division’s fixed income index platform.

Algomi Expands into Custody Market with BNY, HSBC Deals

After a rocky finish to 2016, the London-headquartered fintech firm appears to have stabilized and is looking to the future.

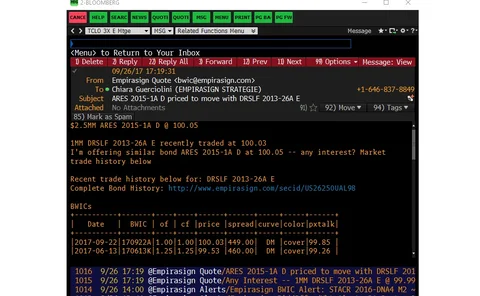

Empirasign Bows ‘Quote Builder’ Bloomberg Email Tool

The tool makes it easier for firms to create custom emails for promoting the offer of a bond to clients, by automating

Algomi to Grow Offering After S&P Investment

This is the third partnership Algomi has formed over the last six months. It’s the second minority investment S&P has made this year.

Axe Trading Targets the Buy Side with New EMS

New platform offers liquidity and venue aggregation for asset managers active in the fixed-income markets

Wiener Börse Feels the Need for Speed with T7 Upgrade

The exchange has replaced its Xetra Classic infrastructure with Deutsche Börse’s T7 trading technology

Neptune Adds Rabobank and TD Securities as Latest Dealers

Trading network adds banks to bring total dealer members to 24.

Tradeweb Invests in DealVector to Grow Fixed-Income Suite of Solutions

DealVector has over 600,000 deals loaded on its platform across more than 1,000 firms and plans to grow that base with this investment.

Deutsche Börse Pumps $10 Million into Trumid

Strategic investment and partnership to drive Trumid's European expansion