Trading Tech

Building Advent Genesis: Getting the Balance Right

Portfolio rebalancing is a persistently tricky problem for investment managers to address, which is why successful platforms in this space must be designed from the ground-up to handle complex rules and deal with large order loads across strategies,…

SmartStream Corporate Actions Video Series Part III: The Risks Associated with Manual Processing

Victor Anderson and Adam Cottingham discuss the upstream and downstream risks associated with manually-intensive corporate actions processes.

APFIC 2017: Cloud’s Data Potential Increases as Industry Evolves

Cloud offers benefits for data suppliers seeking more distribution channels, as well as advantages around usage monitoring and control, panelists said.

Waters Wavelength Podcast Episode 97: C-Level Execs Talk Bitcoin, Fintechs, Cognitive Computing & Open-Source Tech

In separate interviews, executives from AQR, JPMorgan, Cboe and IBM discuss topics permeating the capital markets.

McKay Adds Milan, Zurich PoPs to Microwave Network

In addition to rolling out the new PoPs, McKay will deliver a fully microwave network to Zurich next year.

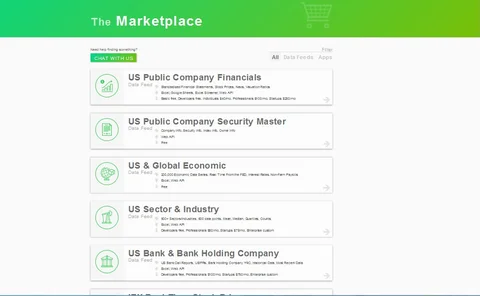

Intrinio Taps Quodd for Nasdaq Data

The combination of Quodd's APIs and datafeed technology with Intrinio's interface and SDKs make it easier for individual and enterprise users to access Nasdaq Basic data.

UPDATE: Bloomberg’s Chat Gambit: The Feint Before a Knockout?

Some suggest that Bloomberg’s decision to introduce a cut-price version of its Instant Bloomberg messaging is a sign that the data giant is rattled by bank-backed secure messaging startup Symphony. Joanne Faulkner investigates whether the move reflects…

LiquidityBook Debuts LBX as Outsourced Trading Popularity Grows

Vendor debuts portfolio, order and execution management system for outsourced trading desks.

Waters Wavelength Podcast Episode 96: CAT Concerns & Big Tech Takes Aim at Asset Managers

Anthony and James look at developments pertaining to the Consolidated Audit Trail and wonder if big-tech companies could challenge traditional asset managers.

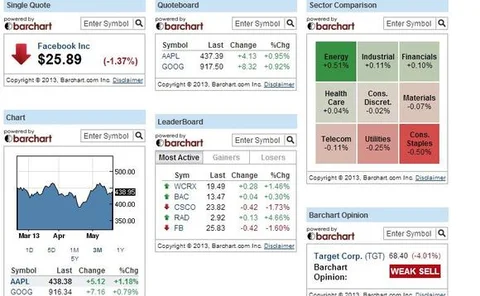

Barchart Enhances Free API Offering

The vendor is looking to take advantage of the gap left by Yahoo Finance, which has discontinued its API service.

Metamako Gains China Sales Certification Nod

The certification—a requirement for vendors wanting to sell technology into China—is an important step in the low-latency switch vendor’s plans to further its expansion in Asia

IHS Markit Unveils OCR and AI for Tax Validation

Optical Character Recognition will take information from tax documents so manual re-keying can be eliminated.

Industry Tight-Lipped on CAT Status as Deadline Hits

Participants refuse to say whether reporting will begin as scheduled after a last-ditch delay effort was rejected by the SEC.

In Capital Markets, Blockchain's Evolution Has Left the Bitcoin Model Behind

Axel Pierron of Opimas looks at five blockchain projects set to go live in 2018 that the industry should keep an eye on.

State Street Takes Aim at ESG Analytics with New Platform

The platform builds on its partnership with TruValue and Arabesque to provide access to ESG data and analytics.

House Approves Market Data Protection Act

Market Data Protection Act will increase security requirements for market data held by the SEC and FINRA, lawmakers say.

CFTC Examining SEF Reform amid Europe Clearing Row

Chairman criticizes European Commission proposals for clearinghouse oversight.

Waters Wavelength Podcast Episode 95: Bitcoin/Blockchain News, BNP's Acquisition, Post-Trade Tech

Anthony and James take a look at some of the biggest news events from the past week.

BNP Paribas Gets into 40 Act Business with Janus Henderson Deal

Andrew Dougherty of BNP Paribas Securities Services talks to WatersTechnology about this recent acquisition and what it means for unit going forward.

Synechron, Xcalar to Build Virtual Data Warehouses

Vendors to build accelerator to showcase virtual data warehousing capabilities for risk and reporting functions.

SIX Appoints Dijsselhof CEO, Launches Venture Fund

SIX has hired Jos Dijsselhof as CEO and announced a new strategy which includes the launch of a CHF 50 million venture fund.

Chicago Catches Crypto Fever with Barrage of Bitcoin Developments

Digital commodities such as bitcoin have captured the imagination of exchange operators but regulators—and even some market participants—are hesitant.

Cash and Liquidity Management Special Report

Requirements for broader liquidity monitoring and increased liquidity thresholds is transforming cash and liquidity management practices and systems

IHS Markit Sets Sights on Post-Trade Derivatives Automation

IHS Markit, in conjunction with CLS and LCH, will automate post-trade processes for complex currency derivatives but is looking at the entire market.