Inside Market Data/Feature

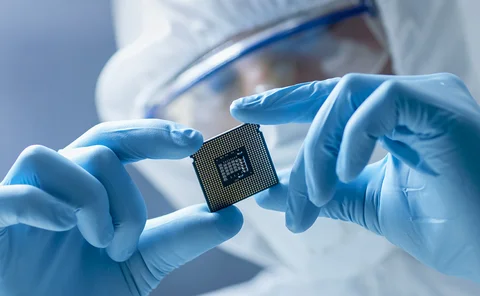

Getting ‘Carded’: Current and Future Uses for FPGAs in Finance

With their origins in industries such as defense, aerospace, and medicine, FPGAs have been used by certain aspects of financial markets for about a decade to gain speed. Wei-Shen Wong examines the current uses for this specialized hardware in finance,…

UPDATE: Markets, Regulators Not Yet United on Mifid II

Just over a week into Europe’s new financial regulatory regime, Joanne Faulkner assess the key challenges that still lie ahead as market participants and regulators alike grapple with the data and reporting requirements of Mifid II.

Law & Disorder: US Preps Defense Against Mifid II

As Mifid II's deadline approaches, US firms affected by the rules are still waiting for regulators to resolve crucial conflicts between European and American laws, and are likely to be making adjustments well after the deadline has passed, reports…

Shining a Light on ‘Dark’ Data

Financial firms are drowning in data, yet for many, information that delivers genuine value remains a scarce resource. Joanne Faulkner investigates whether new approaches to managing internal data could yield new insights, or whether new data privacy…

The Dark Art of Pre-Trade Analytics

Financial firms commonly review trading activity after the fact to improve their execution strategies. But what they’d really love to do is perform that in real time, pre-trade. Max Bowie looks at how far along market participants are in pursuit of this…

EU Gets Tough on ‘Research’ Unbundling

Mifid II will force sell-side firms to unbundle research fees from dealing commissions they charge to buy-side clients. The banks claim their front-office notes meet the criteria of being a minor non-monetary benefit, but EU watchdogs aren’t convinced,…

UPDATE: Bloomberg’s Chat Gambit: The Feint Before a Knockout?

Some suggest that Bloomberg’s decision to introduce a cut-price version of its Instant Bloomberg messaging is a sign that the data giant is rattled by bank-backed secure messaging startup Symphony. Joanne Faulkner investigates whether the move reflects…

Systematic Internalizer Ranks Swell Ahead of Mifid II

While buy- and sell-side firms grapple with the reporting obligations imposed on so-called systematic internalizers under Mifid II, the number of registered SIs continues to grow. Jamie Hyman investigates why more firms are opting in to the designation…

Out with the Old: Australia’s APRA Takes Aim at EFS Data

The Australian Prudential Regulation Authority is overhauling its core regulatory reporting requirements, which includes the modernization of the Economic and Financial Statistics data submissions required from Australian banks and various other…

Will Eonia Sink or Swim in Hunt for Euribor Replacement?

The European Central Bank has intervened to rescue stalling benchmark reform and find a new risk-free rate for swaps. But the Eonia rate has seen dwindling transaction volumes in recent years, and while the ECB’s new overnight rate is regarded as the top…

AI-Spy: Machines Close in on Pricing Manipulators

Artificial intelligence is gaining traction among regulators, exchanges and financial firms sifting through massive amounts of data to spot potential pricing manipulation. Kirsten Hyde asks whether the industry is ready to go all in on AI.

Compliance Countdown: On the Home Stretch to Mifid II

September 25 marked exactly 100 days until Europe’s new financial regulatory framework, Mifid II, becomes law. Jamie Hyman gets the lowdown from market participants and observers on whether the industry is ready, what the remaining three months will look…

Regulators 2.0: Embrace Tech or Be Overwhelmed by Data

To handle the massive increases in data volumes expected from Mifid II regulation and the US Consolidated Audit Trail, regulators are examining their own data governance and technology use, report Joanne Faulkner and Kirsten Hyde.

ANNA DSB Faces Industry Concerns Over ISINs for OTC Derivatives

Licensing and user agreements surrounding ANNA's service burea for OTC derivative ISIN numbers have sparked fireworks over recent months as the service goes live ahead of Mifid II. Joanne Faulkner investigates.

All Aboard the Training Train

Data practitioners have long bemoaned the lack of professional training and standards around data management—especially for those who may unwittingly incur expensive penalties if they don’t abide by licensing policies. Now that industry association…

The ICE Storm: Intercontinental Exchange's Lynn Martin

Intercontinental Exchange has never been shy about making waves. But its recent swathe of acquisitions in the data space have raised the profile of its data business significantly. Max Bowie speaks with Lynn Martin, head of ICE Data Services, about the…

Compliance Countdown: 100 Days to MiFID II

Sept. 25 marks exactly 100 days until Europe’s new financial regulatory framework, MiFID II, becomes law. Jamie Hyman gets the lowdown from industry experts on whether the industry is ready, what the next 100 days will look like, which strategies firms…

Machine Learning: On the Ground Floor, Ready to Rise

While much of the talk about machine-learning technology in capital markets is overblown, there’s no question that these tools are set to become increasingly prevalent over the coming years. Anthony Malakian takes stock of where the industry stands based…

Firms Eye Machine Learning for Liquidity Risk Models

Many US mutual funds are expected to rely on vendor tools to comply with the SEC’s rule that they establish a formal liquidity risk management program that includes classifying the liquidity of their investments. These tools have the potential to improve…

Beware the Commodity Swap Data Swamp

Data quality for over-the-counter commodity swaps reported to swap data repositories, as mandated by the Dodd–Frank Act, has worsened since reporting began more than four years ago, with some blaming the CFTC, while others blame resistance by the SDRs to…

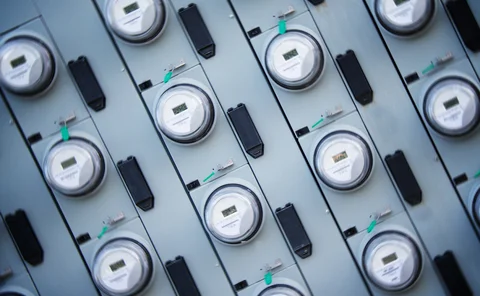

Power to the People: Will MiFID II Data Disaggregation Deliver on Cost Control Promises?

MiFID II’s data disaggregation requirements aim to reduce data costs by forcing marketplaces to unbundle datasets and sell consumers only the specific data they need. But in reality, this seemingly simple and cost-reducing idea could make buying and…

Firms Drag Heels on MiFID II Research Rulebook Rewrite

MiFID II’s ban on broker-subsidized free research will leave sell-side firms with a multitude of challenges—not least how to price research so as not to lose customers who might direct trading elsewhere, without appearing to incentivize clients to trade…

Baking a Distributed Ledger Layer Cake in a Data Oven

Much of distributed ledgers’ potential lies in their shared data layer. Yet ledgers’ rapid rise has moved mostly apart from data management and data managers. Tim Bourgaize Murray explores the reasons why, and the possible opportunities within the world…

Secret Formula: Sequencing the Genome of Data Scientists

Many firms are creating data science teams to gain insights from new sources of unstructured and alternative data. But finding people with the right skillsets within the financial markets ecosystem is proving to be a barrier that slows firms’ ability to…