News

Hochstein Gets Global Entity Data Role at TR

Hochstein's role moves Thomson Reuters toward goal of aligning and scaling various reference data services.

Nasdaq Joins SI Registry

The SI Registry now has seven participants as Nasdaq becomes the latest APA to opt in.

Arkéa to Integrate NeoXam’s PMS

Paris-based asset manager selects NeoXam technology to bolster front and middle office.

InvestCloud Buys Client Relationship Solutions Provider rplan

The acquisition also brings InvestCloud more clients in Europe.

Bank Execs Call for Regulatory Harmonization and Cross-Border Clarity

Panelists discuss operational issues involved in cross-border compliance with Mifid II.

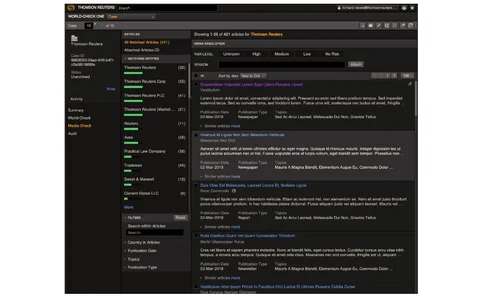

Thomson Reuters Uses AI to Turn World-Check Tool into Financial Robocop

Using artificial intelligence and machine learning will help make Thomson Reuters News Check tool more accurate in identifying relationships between events and individuals.

Dash Hires Agency Brokerage Vet Lesko

Lesko will come on board as chief growth officer.

J&J Taps Deutsche Exec for Compliance Consulting

Montagnino has held a range of compliance and surveillance-related roles at banks and trading firms.

Citi Market Strategist: Fintechs Key for Banks’ Data Demands

Citi regulatory and market strategist attests that fintech and bank collaboration is essential for better data management.

Datactics Debuts Free LEI ‘Health Check’ and Matching Solution

Cloud-based software allows firms to cross-reference more than 1.2 million LEIs via data from GLEIF.

Nasdaq Debuts ‘Direct’ Hong Kong Connectivity with New PoPs, Eyes Level 2 Data Sales in Asia

Beyond making its data more accessible to Asia-Pacific traders, the exchange is exploring options to also provide more in-depth data to investors in the region.

SBI Invests in High-Speed Broker Potamus

The investment is expected to help expand business in the US and other asset classes.

Bitcoin Regulation on the Agenda for Global Policymakers

Expert panel struck a positive tone on the future of crypto assets and indicated that it was only a matter time until regulation caught up with the digital age.

GreenKey Files Patent for Automatic Transcription Process

The patent covers a process that determines an audio language before being run through a transcription engine.

BSO Preps Network, Office Expansion to Meet Growing Asia Demand

To support the growth of its network in Asia Pacific, BSO is looking at potentially rolling out microwave connectivity from recent acquisition Apsara across the region.

BNP Extends Fidessa Partnership for Derivatives

BNP will offer Fidessa's front office execution platform for derivatives to its global client base.

Auction System Glitch Led To LSE's Morning Blackout

London bourse's trading delay was the first such disruption in years.

Northern Trust Pushes Forward with Private-Equity Blockchain

Two firms are already live on the platform, with another three soon to be up and running.

Money.Net Taps Wall Street Horizon for Event Data

The vendor says clients are increasingly looking for datasets that deliver signals of volatility around a company's stock price.

Former MarketAxess Exec Eaton Takes Reins at Algomi

The fixed-income specialist has been appointed to the chief executive role at the fintech firm.

Morgan Stanley Moves Beaton to Head US Trade and Transaction Reporting

Beaton brings to the new role 15 years of expertise in financial services program management, regulatory and risk oversight, and audit trail recovery and management.

Crypto Exchange Blockbid Deploys Bank-Grade KYC Tech

Blockbid signs LexisNexis Risk and ThreatMetrix to combat fraud.

US Regulators Release Final Rules for T+2

The final ruling from two US prudential regulators aligns both agencies with the markets regulator.

TNS Realigns Product Management, Development Ops Under Telecoms Vet Versen

Versen has spent almost 30 years in product and digital marketing and management roles at network and technology providers, and marketing agencies.